Is Stericycle Inc (NASDAQ:SRCL) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments. More recently the top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters (S&P 500 Index funds returned only 7.6% during the same period).

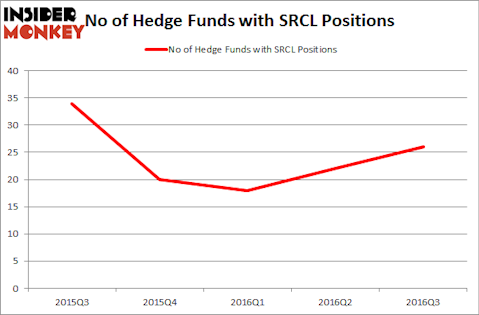

Stericycle Inc (NASDAQ:SRCL) investors should pay attention to an increase in support from the world’s most elite money managers lately. SRCL was in 26 hedge funds’ portfolios at the end of September. There were 22 hedge funds in our database with SRCL positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Advanced Semiconductor Engineering (ADR) (NYSE:ASX), Coty Inc (NYSE:COTY), and Arch Capital Group Ltd. (NASDAQ:ACGL) to gather more data points.

Follow Stericycle Inc (NASDAQ:SRCL)

Follow Stericycle Inc (NASDAQ:SRCL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Lisa S./Shutterstock.com

Now, we’re going to go over the latest action surrounding Stericycle Inc (NASDAQ:SRCL).

How are hedge funds trading Stericycle Inc (NASDAQ:SRCL)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a jump of 18% from one quarter earlier. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, David Blood and Al Gore’s Generation Investment Management has the biggest position in Stericycle Inc (NASDAQ:SRCL), worth close to $187.5 million, accounting for 2% of its total 13F portfolio. The second most bullish fund manager is Echo Street Capital Management, run by Greg Poole, which holds a $41.3 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Other peers that are bullish encompass Dmitry Balyasny’s Balyasny Asset Management, Ken Griffin’s Citadel Investment Group and Richard Driehaus’s Driehaus Capital.

As industrywide interest jumped, key money managers have been driving this bullishness. Laurion Capital Management, led by Benjamin A. Smith, established the biggest call position in Stericycle Inc (NASDAQ:SRCL). According to regulatory filings, the fund had $22 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $21.1 million position during the quarter. The following funds were also among the new SRCL investors: Jim Simons’s Renaissance Technologies, John A. Levin’s Levin Capital Strategies, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Stericycle Inc (NASDAQ:SRCL) but similarly valued. We will take a look at Advanced Semiconductor Engineering (ADR) (NYSE:ASX), Coty Inc (NYSE:COTY), Arch Capital Group Ltd. (NASDAQ:ACGL), and Newfield Exploration Co. (NYSE:NFX). This group of stocks’ market values are closest to SRCL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASX | 15 | 198429 | 2 |

| COTY | 46 | 3034196 | 33 |

| ACGL | 18 | 812370 | -6 |

| NFX | 45 | 738096 | 0 |

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1.19 billion. That figure was $460 million in SRCL’s case. Coty Inc (NYSE:COTY) is the most popular stock in this table. On the other hand Advanced Semiconductor Engineering (ADR) (NYSE:ASX) is the least popular one with only 15 bullish hedge fund positions. Stericycle Inc (NASDAQ:SRCL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard COTY might be a better candidate to consider a long position.

Disclosure: none.