Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze ServisFirst Bancshares, Inc. (NASDAQ:SFBS) from the perspective of those successful funds.

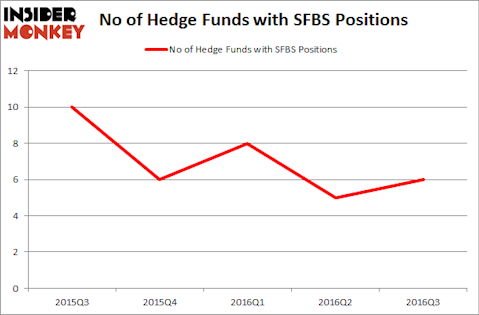

Is ServisFirst Bancshares, Inc. (NASDAQ:SFBS) a buy right now? Hedge funds are altogether in an optimistic mood. The number of bullish hedge fund bets that are revealed through the 13F filings swelled by 1 recently. SFBS was in 6 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with SFBS positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Acceleron Pharma Inc (NASDAQ:XLRN), SkyWest, Inc. (NASDAQ:SKYW), and Yadkin Financial Corp (NASDAQ:YDKN) to gather more data points.

Follow Servisfirst Bancshares Inc. (NYSE:SFBS)

Follow Servisfirst Bancshares Inc. (NYSE:SFBS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, let’s go over the fresh action surrounding ServisFirst Bancshares, Inc. (NASDAQ:SFBS).

How have hedgies been trading ServisFirst Bancshares, Inc. (NASDAQ:SFBS)?

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a boost of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SFBS over the last 5 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Chuck Royce’s Royce & Associates has the biggest position in ServisFirst Bancshares, Inc. (NASDAQ:SFBS), worth close to $4.6 million, comprising less than 0.1% of its total 13F portfolio. On Royce & Associates’s heels is Fisher Asset Management, led by Ken Fisher, which holds a $3.2 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism contain Cliff Asness’ AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Matthew Tewksbury’s Stevens Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.