The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider Omega Healthcare Investors Inc (NYSE:OHI) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

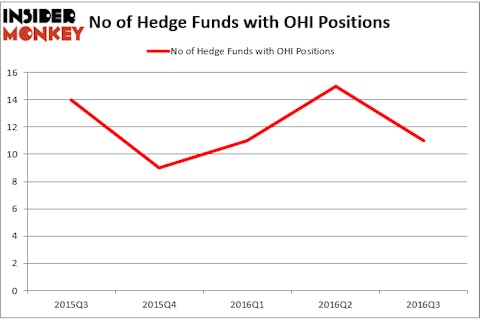

Omega Healthcare Investors Inc (NYSE:OHI) investors should pay attention to a decrease in hedge fund interest of late. There were 15 hedge funds in our database with OHI holdings at the end of the previous quarter, versus 11 at the end of Q3. At the end of this article we will also compare OHI to other stocks including Southwestern Energy Company (NYSE:SWN), Lennox International Inc. (NYSE:LII), and W.P. Carey Inc. REIT (NYSE:WPC) to get a better sense of its popularity.

Follow Omega Healthcare Investors Inc (NYSE:OHI)

Follow Omega Healthcare Investors Inc (NYSE:OHI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andrei Rahalski/Shutterstock.com

Keeping this in mind, let’s take a glance at the fresh action regarding Omega Healthcare Investors Inc (NYSE:OHI).

How are hedge funds trading Omega Healthcare Investors Inc (NYSE:OHI)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in OHI at the beginning of this year. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Two Sigma Advisors, led by John Overdeck and David Siegel, holds the most valuable position in Omega Healthcare Investors Inc (NYSE:OHI). Two Sigma Advisors has a $13.9 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is Renaissance Technologies, one of the biggest hedge funds in the world, holding a $11.3 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Ken Griffin’s Citadel Investment Group, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.