Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

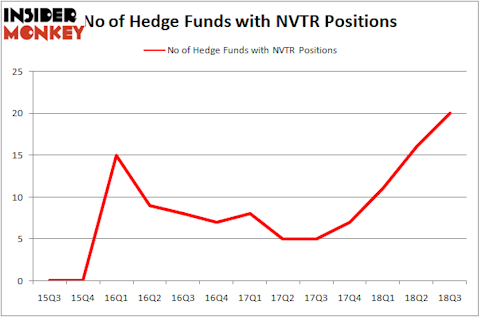

Nuvectra Corporation (NASDAQ:NVTR) was in 20 hedge funds’ portfolios at the end of September. NVTR investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. There were 16 hedge funds in our database with NVTR positions at the end of the previous quarter. Our calculations also showed that NVTR isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are seen as unimportant, outdated investment tools of years past. While there are more than 8,000 funds trading today, We choose to focus on the elite of this club, around 700 funds. These money managers handle the majority of the smart money’s total asset base, and by monitoring their inimitable stock picks, Insider Monkey has unsheathed numerous investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the recent hedge fund action encompassing Nuvectra Corporation (NASDAQ:NVTR).

Hedge fund activity in Nuvectra Corporation (NASDAQ:NVTR)

Heading into the fourth quarter of 2018, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NVTR over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Richard Driehaus’s Driehaus Capital has the number one position in Nuvectra Corporation (NASDAQ:NVTR), worth close to $16.5 million, comprising 0.5% of its total 13F portfolio. Sitting at the No. 2 spot is Point72 Asset Management, managed by Steve Cohen, which holds a $7.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism contain Samuel Isaly’s OrbiMed Advisors, Daniel Lascano’s Lomas Capital Management and James E. Flynn’s Deerfield Management.

As industrywide interest jumped, some big names have jumped into Nuvectra Corporation (NASDAQ:NVTR) headfirst. Point72 Asset Management, managed by Steve Cohen, assembled the most outsized position in Nuvectra Corporation (NASDAQ:NVTR). Point72 Asset Management had $7.9 million invested in the company at the end of the quarter. Samuel Isaly’s OrbiMed Advisors also initiated a $7.7 million position during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Dmitry Balyasny’s Balyasny Asset Management, and Efrem Kamen’s Pura Vida Investments.

#N/A

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SD | 19 | 113215 | -1 |

| CDMO | 11 | 16233 | 5 |

| QABA | 2 | 6358 | 1 |

| NAN | 1 | 651 | -1 |

| Average | 8.25 | 34114 | 1 |

View table here if you experience formatting issues.

#N/A