You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

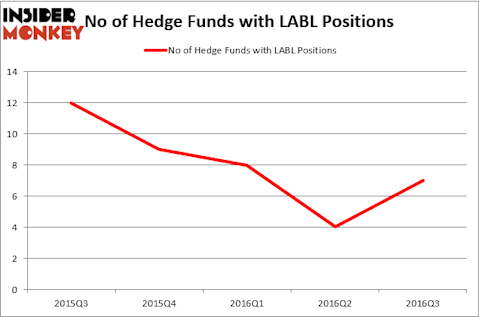

Is Multi-Color Corporation (NASDAQ:LABL) a healthy stock for your portfolio? Money managers are really in a bullish mood. The number of bullish hedge fund bets that are revealed through the 13F filings moved up by 3 in recent months. There were 7 hedge funds in our database with LABL holdings at the end of the third quarter. At the end of this article we will also compare LABL to other stocks including Orion Engineered Carbons SA (NYSE:OEC), Momo Inc (ADR) (NASDAQ:MOMO), and Adeptus Health Inc (NYSE:ADPT) to get a better sense of its popularity.

Follow Multi Color Corp (NASDAQ:LABL)

Follow Multi Color Corp (NASDAQ:LABL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

violetkaipa/Shutterstock.com

With all of this in mind, let’s review the fresh action encompassing Multi-Color Corporation (NASDAQ:LABL).

How are hedge funds trading Multi-Color Corporation (NASDAQ:LABL)?

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a boost of 75% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LABL over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Joho Capital, led by Robert Karr, holds the number one position in Multi-Color Corporation (NASDAQ:LABL). According to regulatory filings, the fund has a $30.3 million position in the stock, comprising 6% of its 13F portfolio. The second largest stake is held by Third Avenue Management, led by Martin Whitman, which holds a $7.4 million position; 0.3% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish consist of Paul Hondros’s AlphaOne Capital Partners, Ken Fisher’s Fisher Asset Management and Richard Driehaus’s Driehaus Capital. We should note that Joho Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, specific money managers have been driving this bullishness. Driehaus Capital, led by Richard Driehaus, initiated the most outsized position in Multi-Color Corporation (NASDAQ:LABL). According to its latest 13F filing, the fund had $1.7 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $0.5 million position during the quarter. The only other fund with a brand new LABL position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks similar to Multi-Color Corporation (NASDAQ:LABL). We will take a look at Orion Engineered Carbons SA (NYSE:OEC), Momo Inc (ADR) (NASDAQ:MOMO), Adeptus Health Inc (NYSE:ADPT), and Arcos Dorados Holding Inc (NYSE:ARCO). This group of stocks’ market caps match LABL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OEC | 12 | 121102 | -1 |

| MOMO | 19 | 233825 | 10 |

| ADPT | 13 | 183864 | -11 |

| ARCO | 15 | 34054 | 6 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $143 million. That figure was $46 million in LABL’s case. Momo Inc (ADR) (NASDAQ:MOMO) is the most popular stock in this table. On the other hand Orion Engineered Carbons SA (NYSE:OEC) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Multi-Color Corporation (NASDAQ:LABL) is even less popular than OEC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none.