You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

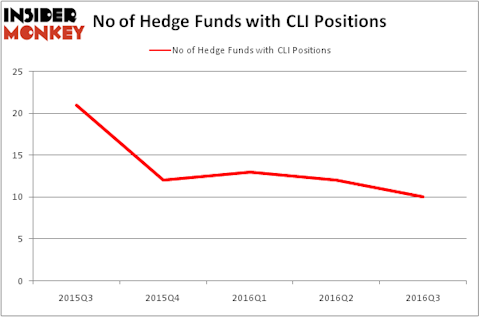

Mack Cali Realty Corp (NYSE:CLI) shareholders have witnessed a decrease in hedge fund interest lately. CLI was in 10 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with CLI positions at the end of the previous quarter. At the end of this article we will also compare CLI to other stocks including Visteon Corp (NYSE:VC), INC Research Holdings Inc (NASDAQ:INCR), and Churchill Downs, Inc. (NASDAQ:CHDN) to get a better sense of its popularity.

Follow Veris Residential Inc. (NYSE:VRE)

Follow Veris Residential Inc. (NYSE:VRE)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Now, we’re going to review the new action surrounding Mack Cali Realty Corp (NYSE:CLI).

How are hedge funds trading Mack Cali Realty Corp (NYSE:CLI)?

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decline of 17% from one quarter earlier. By comparison, 12 hedge funds held shares or bullish call options in CLI heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies has the biggest position in Mack Cali Realty Corp (NYSE:CLI), worth close to $33.6 million, accounting for 0.1% of its total 13F portfolio. Coming in second is Land & Buildings Investment Management, led by Jonathan Litt, which holds a $32.7 million position; 8.4% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions encompass J. Alan Reid, Jr.’s Forward Management, Ken Fisher’s Fisher Asset Management and Chuck Royce’s Royce & Associates. We should note that Forward Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Mack Cali Realty Corp (NYSE:CLI) has encountered a decline in interest from the aggregate hedge fund industry, it’s safe to say that there exists a select few money managers that slashed their full holdings by the end of the third quarter. At the top of the heap, Richard Driehaus’ Driehaus Capital said goodbye to the biggest investment of all the hedgies studied by Insider Monkey, comprising an estimated $0.7 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also dumped its call options, about $0.6 million worth.

Let’s also examine hedge fund activity in other stocks similar to Mack Cali Realty Corp (NYSE:CLI). We will take a look at Visteon Corp (NYSE:VC), INC Research Holdings Inc (NASDAQ:INCR), Churchill Downs, Inc. (NASDAQ:CHDN), and Cathay General Bancorp (NASDAQ:CATY). This group of stocks’ market caps resemble CLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VC | 29 | 587838 | -2 |

| INCR | 30 | 367630 | 5 |

| CHDN | 19 | 704814 | 3 |

| CATY | 12 | 38855 | 0 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $425 million. That figure was $114 million in CLI’s case. INC Research Holdings Inc (NASDAQ:INCR) is the most popular stock in this table. On the other hand Cathay General Bancorp (NASDAQ:CATY) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Mack Cali Realty Corp (NYSE:CLI) is even less popular than CATY. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none