We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Lumos Networks Corp (NASDAQ:LMOS) , and what that likely means for the prospects of the company and its stock.

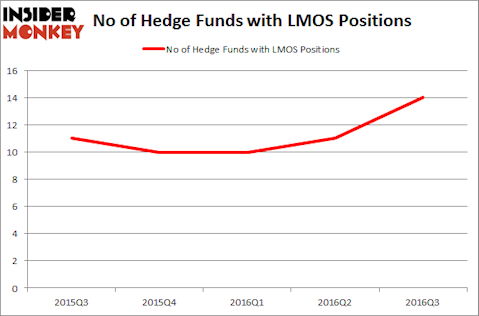

Lumos Networks Corp (NASDAQ:LMOS) has experienced an increase in hedge fund interest recently. There were 14 hedge funds in our database with LMOS holdings at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Acacia Research Corporation (NASDAQ:ACTG), pdvWireless Inc (NASDAQ:PDVW), and Xcerra Corp (NASDAQ:XCRA) to gather more data points.

Follow Lumos Networks Corp. (NASDAQ:LMOS)

Follow Lumos Networks Corp. (NASDAQ:LMOS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Stokkete/Shutterstock.com

Keeping this in mind, let’s take a look at the new action surrounding Lumos Networks Corp (NASDAQ:LMOS).

What have hedge funds been doing with Lumos Networks Corp (NASDAQ:LMOS)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, growth of 27% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in LMOS at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Archer Capital Management, led by Eric Edidin and Josh Lobel, holds the number one position in Lumos Networks Corp (NASDAQ:LMOS). Archer Capital Management has a $28.2 million position in the stock, comprising 7.1% of its 13F portfolio. On Archer Capital Management’s heels is Spencer M. Waxman of Shannon River Fund Management, with a $6.5 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish consist of Renaissance Technologies, one of the largest hedge funds in the world, Israel Englander’s Millennium Management and Manoneet Singh’s Kavi Asset Management. We should note that two of these hedge funds (Archer Capital Management and Shannon River Fund Management) are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key money managers were breaking ground themselves. Kavi Asset Management, led by Manoneet Singh, initiated the most outsized position in Lumos Networks Corp (NASDAQ:LMOS). Kavi Asset Management had $2.1 million invested in the company at the end of the quarter. Bart Baum’s Ionic Capital Management also made a $0.9 million investment in the stock during the quarter. The only other fund with a brand new LMOS position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Lumos Networks Corp (NASDAQ:LMOS) but similarly valued. These stocks are Acacia Research Corporation (NASDAQ:ACTG), pdvWireless Inc (NASDAQ:PDVW), Xcerra Corp (NASDAQ:XCRA), and Preferred Apartment Communities Inc. (NYSE:APTS). This group of stocks’ market valuations match LMOS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACTG | 13 | 56058 | 2 |

| PDVW | 5 | 157424 | -1 |

| XCRA | 13 | 49892 | 2 |

| APTS | 7 | 4719 | 7 |

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $53 million in LMOS’s case. Acacia Research Corporation (NASDAQ:ACTG) is the most popular stock in this table. On the other hand pdvWireless Inc (NASDAQ:PDVW) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Lumos Networks Corp (NASDAQ:LMOS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None