Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about Kimball International Inc (NASDAQ:KBAL).

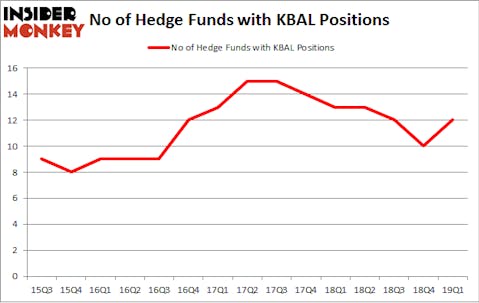

Kimball International Inc (NASDAQ:KBAL) has seen an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that KBAL isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the new hedge fund action regarding Kimball International Inc (NASDAQ:KBAL).

How are hedge funds trading Kimball International Inc (NASDAQ:KBAL)?

At the end of the first quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the previous quarter. By comparison, 13 hedge funds held shares or bullish call options in KBAL a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Kimball International Inc (NASDAQ:KBAL), with a stake worth $36 million reported as of the end of March. Trailing Renaissance Technologies was Royce & Associates, which amassed a stake valued at $32.9 million. D E Shaw, AQR Capital Management, and Ancora Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Tudor Investment Corp, managed by Paul Tudor Jones, initiated the most valuable position in Kimball International Inc (NASDAQ:KBAL). Tudor Investment Corp had $0.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.3 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Kimball International Inc (NASDAQ:KBAL) but similarly valued. We will take a look at Zymeworks Inc. (NYSE:ZYME), Rosetta Stone Inc (NYSE:RST), e.l.f. Beauty, Inc. (NYSE:ELF), and EZCORP Inc (NASDAQ:EZPW). This group of stocks’ market valuations resemble KBAL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZYME | 14 | 120820 | 3 |

| RST | 19 | 126725 | 7 |

| ELF | 18 | 117892 | 1 |

| EZPW | 20 | 116774 | 0 |

| Average | 17.75 | 120553 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $121 million. That figure was $88 million in KBAL’s case. EZCORP Inc (NASDAQ:EZPW) is the most popular stock in this table. On the other hand Zymeworks Inc. (NYSE:ZYME) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Kimball International Inc (NASDAQ:KBAL) is even less popular than ZYME. Hedge funds clearly dropped the ball on KBAL as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on KBAL as the stock returned 18.7% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.