Is iShares Barclays 20+ Yr Treas.Bond (ETF) (NASDAQ:TLT) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

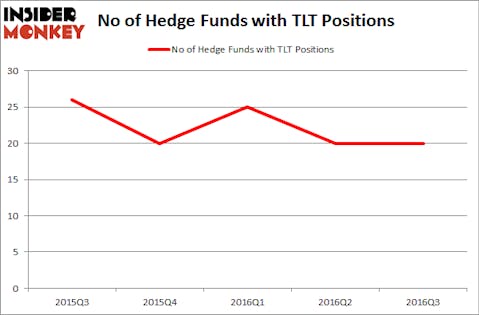

iShares Barclays 20+ Yr Treas.Bond (ETF) (NASDAQ:TLT) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 20 hedge funds’ portfolios at the end of September. At the end of this article we will also compare TLT to other stocks including YPF SA (ADR) (NYSE:YPF), RPM International Inc. (NYSE:RPM), and Fluor Corporation (NEW) (NYSE:FLR) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Pressmaster/Shutterstock.com

Now, we’re going to check out the new action encompassing iShares Barclays 20+ Yr Treas.Bond (ETF) (NASDAQ:TLT).

How are hedge funds trading iShares Barclays 20+ Yr Treas.Bond (ETF)(NASDAQ:TLT)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in TLT, unchanged over the quarter. At the beginning of 2016, also 20 funds held shares of bullish call options in TLT. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Hari Hariharan’s NWI Management has the number one call position in iShares Barclays 20+ Yr Treas.Bond (ETF)(NASDAQ:TLT), worth close to $187.3 million, comprising 19.6% of its total 13F portfolio. Sitting at the No. 2 spot is Citadel Investment Group, led by Ken Griffin, which holds a $115.6 million call position; 0.1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that are bullish consist of Michael Platt and William Reeves’ BlueCrest Capital Mgmt., and Sander Gerber’s Hudson Bay Capital Management. We should note that Hudson Bay Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

On the next page, we’ll see the popularity of TLT among smart money investors compared to four companies with similar market caps.

Let’s check out hedge fund activity in other stocks similar to iShares Barclays 20+ Yr Treas.Bond (ETF)(NASDAQ:TLT). We will take a look at YPF SA (ADR) (NYSE:YPF), RPM International Inc. (NYSE:RPM), Fluor Corporation (NEW) (NYSE:FLR), and Crescent Point Energy Corp (NYSE:CPG). This group of stocks’ market values are closest to TLT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YPF | 19 | 360036 | -7 |

| RPM | 25 | 129774 | 4 |

| FLR | 24 | 226331 | -2 |

| CPG | 16 | 47001 | -2 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $191 million. That figure was $652 million in TLT’s case. RPM International Inc. (NYSE:RPM) is the most popular stock in this table. On the other hand Crescent Point Energy Corp (NYSE:CPG) is the least popular one with only 16 bullish hedge fund positions. iShares Barclays 20+ Yr Treas.Bond (ETF) (NASDAQ:TLT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RPM International Inc. (NYSE:RPM) might be a better candidate to consider taking a long position in.\

Disclosure: none