We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article we look at what those investors think of Gilead Sciences, Inc. (NASDAQ:GILD).

Gilead Sciences, Inc. (NASDAQ:GILD) shareholders have witnessed an increase in enthusiasm from smart money recently. To get a better sense of its popularity, at the end of this article we will also compare GILD to other stocks including BP plc (ADR) (NYSE:BP), Sanofi SA (ADR) (NYSE:SNY), and Kraft Heinz Co (NASDAQ:KHC).

Follow Gilead Sciences Inc. (NASDAQ:GILD)

Follow Gilead Sciences Inc. (NASDAQ:GILD)

Receive real-time insider trading and news alerts

If you’d ask most market participants, hedge funds are assumed to be underperforming, outdated financial tools of the past. While there are more than 8000 funds with their doors open at present, Our researchers choose to focus on the leaders of this club, around 700 funds. Most estimates calculate that this group of people preside over the majority of the smart money’s total asset base, and by observing their unrivaled picks, Insider Monkey has discovered a number of investment strategies that have historically surpassed the market. Insider Monkey’s small-cap hedge fund strategy exceeded the S&P 500 index by 12 percentage points per year for a decade in their back tests.

kurhan / shutterstock.com

With all of this in mind, we’re going to take a look at the latest action regarding Gilead Sciences, Inc. (NASDAQ:GILD).

How are hedge funds trading Gilead Sciences, Inc. (NASDAQ:GILD)?

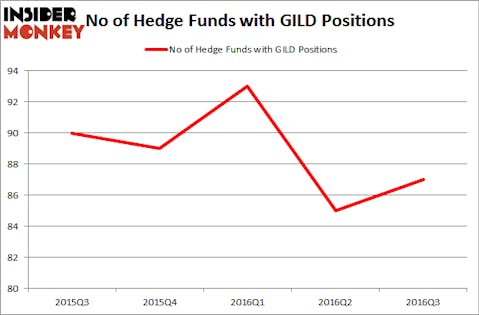

At the end of September, 87 of the hedge funds tracked by Insider Monkey were bullish on Gilead, a change of 2% from the end of the second quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Passport Capital, managed by John Burbank, holds the number one position in Gilead Sciences, Inc. (NASDAQ:GILD). Passport Capital has a $395.6 million ‘call’ position in the stock, comprising 8.2% of its 13F portfolio. The second most bullish fund manager is AQR Capital Management, led by Cliff Asness, holding a $329.2 million position; 0.5% of its 13F portfolio is allocated to the company. Other peers with similar optimism consist of John Overdeck and David Siegel’s Two Sigma Advisors, John A. Levin’s Levin Capital Strategies and Phill Gross and Robert Atchinson’s Adage Capital Management.

Consequently, key money managers were leading the bulls’ herd. Among these funds, Ken Griffin’s Citadel Investment Group initiated a $116.7 million position during the quarter. The following funds were also among the new GILD investors: Hal Mintz’s Sabby Capital, Mike Masters’s Masters Capital Management, and Conan Laughlin’s North Tide Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Gilead Sciences, Inc. (NASDAQ:GILD) but similarly valued. These stocks are BP plc (ADR) (NYSE:BP), Sanofi SA (ADR) (NYSE:SNY), Kraft Heinz Co (NASDAQ:KHC), and NTT Docomo Inc (ADR) (NYSE:DCM). All of these stocks’ market caps are closest to GILD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BP | 30 | 1064994 | -10 |

| SNY | 30 | 716205 | -2 |

| KHC | 52 | 31239057 | -8 |

| DCM | 6 | 91843 | -2 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $8.28 billion. That figure was $3.47 billion in Gilead’s case. Kraft Heinz Co (NASDAQ:KHC) is the most popular stock in this table with 52 funds reporting long positions as of the end of September, while NTT Docomo Inc (ADR) (NYSE:DCM) is the least popular one. Compared to these stocks Gilead Sciences, Inc. (NASDAQ:GILD) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.