Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

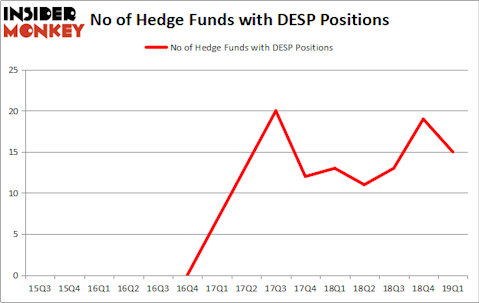

Is Despegar.com, Corp. (NYSE:DESP) a buy here? Prominent investors are taking a bearish view. The number of bullish hedge fund positions retreated by 4 recently. Our calculations also showed that DESP isn’t among the 30 most popular stocks among hedge funds. DESP was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. There were 19 hedge funds in our database with DESP positions at the end of the previous quarter.

In the financial world there are several tools investors use to analyze stocks. A couple of the less utilized tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the broader indices by a solid amount (see the details here).

Let’s take a look at the recent hedge fund action encompassing Despegar.com, Corp. (NYSE:DESP).

How are hedge funds trading Despegar.com, Corp. (NYSE:DESP)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards DESP over the last 15 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Tiger Global Management held the most valuable stake in Despegar.com, Corp. (NYSE:DESP), which was worth $181.3 million at the end of the first quarter. On the second spot was Bares Capital Management which amassed $12.8 million worth of shares. Moreover, Two Creeks Capital Management, D E Shaw, and Millennium Management were also bullish on Despegar.com, Corp. (NYSE:DESP), allocating a large percentage of their portfolios to this stock.

Because Despegar.com, Corp. (NYSE:DESP) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of hedgies that slashed their entire stakes heading into Q3. Intriguingly, Greg Poole’s Echo Street Capital Management said goodbye to the biggest investment of the “upper crust” of funds tracked by Insider Monkey, valued at close to $6.3 million in stock, and David Halpert’s Prince Street Capital Management was right behind this move, as the fund dropped about $5.9 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 4 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Despegar.com, Corp. (NYSE:DESP) but similarly valued. We will take a look at Veracyte Inc (NASDAQ:VCYT), Luminex Corporation (NASDAQ:LMNX), Cango Inc. (NYSE:CANG), and Kraton Corporation (NYSE:KRA). All of these stocks’ market caps match DESP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VCYT | 22 | 130377 | 5 |

| LMNX | 21 | 159503 | 2 |

| CANG | 2 | 681 | 0 |

| KRA | 19 | 97961 | 2 |

| Average | 16 | 97131 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $97 million. That figure was $227 million in DESP’s case. Veracyte Inc (NASDAQ:VCYT) is the most popular stock in this table. On the other hand Cango Inc. (NYSE:CANG) is the least popular one with only 2 bullish hedge fund positions. Despegar.com, Corp. (NYSE:DESP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately DESP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); DESP investors were disappointed as the stock returned -8.3% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.