Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying for a while now that the current market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the fourth quarter, many investors lost money due to unpredictable events such as the sudden increase in long-term interest rates and unintended consequences of the trade war with China. Nevertheless, many of the stocks that tanked in the third quarter still sport strong fundamentals and their decline was more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Cabot Oil & Gas Corporation (NYSE:COG) changed recently.

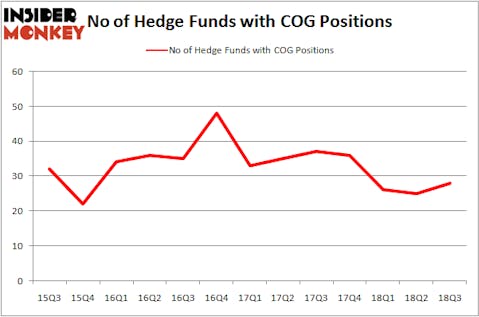

Cabot Oil & Gas Corporation (NYSE:COG) has seen an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that COG isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are viewed as worthless, old financial vehicles of yesteryear. While there are over 8,000 funds with their doors open today, Our researchers hone in on the moguls of this group, about 700 funds. These money managers command bulk of all hedge funds’ total asset base, and by monitoring their highest performing stock picks, Insider Monkey has uncovered various investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the key hedge fund action regarding Cabot Oil & Gas Corporation (NYSE:COG).

What have hedge funds been doing with Cabot Oil & Gas Corporation (NYSE:COG)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 12% from the previous quarter. On the other hand, there were a total of 36 hedge funds with a bullish position in COG at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

More specifically, Stelliam Investment Management was the largest shareholder of Cabot Oil & Gas Corporation (NYSE:COG), with a stake worth $369.2 million reported as of the end of September. Trailing Stelliam Investment Management was Luminus Management, which amassed a stake valued at $210.5 million. Millennium Management, Point72 Asset Management, and Stelliam Investment Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have jumped into Cabot Oil & Gas Corporation (NYSE:COG) headfirst. Brenham Capital Management, managed by John Labanowski, initiated the most valuable position in Cabot Oil & Gas Corporation (NYSE:COG). Brenham Capital Management had $43.9 million invested in the company at the end of the quarter. Vince Maddi and Shawn Brennan’s SIR Capital Management also made a $10.8 million investment in the stock during the quarter. The other funds with brand new COG positions are Mitch Cantor’s Mountain Lake Investment Management and Nick Thakore’s Diametric Capital.

Let’s also examine hedge fund activity in other stocks similar to Cabot Oil & Gas Corporation (NYSE:COG). These stocks are American Financial Group, Inc. (NYSE:AFG), Iron Mountain Incorporated (NYSE:IRM), Huaneng Power International Inc (NYSE:HNP), and Nielsen Holdings plc (NYSE:NLSN). All of these stocks’ market caps are similar to COG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFG | 24 | 333576 | 7 |

| IRM | 20 | 107350 | 6 |

| HNP | 4 | 1992 | -1 |

| NLSN | 35 | 1088943 | 14 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $383 million. That figure was $1.03 billion in COG’s case. Nielsen Holdings plc (NYSE:NLSN) is the most popular stock in this table. On the other hand Huaneng Power International Inc (NYSE:HNP) is the least popular one with only 4 bullish hedge fund positions. Cabot Oil & Gas Corporation (NYSE:COG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NLSN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.