Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards BHP Group Limited (NYSE:BHP).

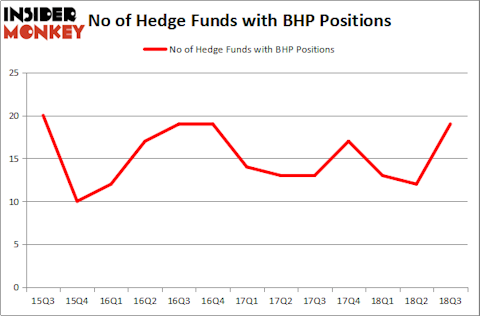

BHP Group Limited (NYSE:BHP) was in 19 hedge funds’ portfolios at the end of September. BHP investors should be aware of an increase in enthusiasm from smart money of late. There were 12 hedge funds in our database with BHP positions at the end of the previous quarter. Our calculations also showed that BHP isn’t among the 30 most popular stocks among hedge funds.BHP Group Limited

To most traders, hedge funds are perceived as slow, outdated financial tools of yesteryear. While there are more than 8,000 funds with their doors open at present, Our experts choose to focus on the leaders of this club, around 700 funds. It is estimated that this group of investors administer most of all hedge funds’ total asset base, and by paying attention to their unrivaled stock picks, Insider Monkey has discovered a few investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to check out the new hedge fund action surrounding BHP Group Limited (NYSE:BHP).

Hedge fund activity in BHP Group Limited (NYSE:BHP)

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 58% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BHP over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the largest position in BHP Group Limited (NYSE:BHP). Fisher Asset Management has a $322.7 million position in the stock, comprising 0.4% of its 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $153.2 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish contain Kenneth Mario Garschina’s Mason Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and Michael Hintze’s CQS Cayman LP.

Now, some big names were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, established the most outsized position in BHP Group Limited (NYSE:BHP). Renaissance Technologies had $12.4 million invested in the company at the end of the quarter. Jonathan Barrett and Paul Segal’s Luminus Management also made a $8.3 million investment in the stock during the quarter. The other funds with brand new BHP positions are Louis Bacon’s Moore Global Investments, Jeffrey Talpins’s Element Capital Management, and ZilvinasáMecelis’s Covalis Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as BHP Group Limited (NYSE:BHP) but similarly valued. We will take a look at Adobe Inc. (NASDAQ:ADBE), McDonald’s Corporation (NYSE:MCD), Abbott Laboratories (NYSE:ABT), and Philip Morris International Inc. (NYSE:PM). This group of stocks’ market values are closest to BHP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADBE | 79 | 7922225 | 12 |

| MCD | 38 | 1160776 | -6 |

| ABT | 53 | 1698396 | -1 |

| PM | 41 | 2897202 | -2 |

| Average | 52.75 | 3419650 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 52.75 hedge funds with bullish positions and the average amount invested in these stocks was $3.42 billion. That figure was $618 million in BHP’s case. Adobe Inc. (NASDAQ:ADBE) is the most popular stock in this table. On the other hand McDonald’s Corporation (NYSE:MCD) is the least popular one with only 38 bullish hedge fund positions. Compared to these stocks BHP Group Limited (NYSE:BHP) is even less popular than MCD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.