Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Bank of America Corp (NYSE:BAC) based on that data.

Bank of America Corp (NYSE:BAC) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM), Altria Group Inc (NYSE:MO), and UnitedHealth Group Inc. (NYSE:UNH) to gather more data points.

Follow Bank Of America Corp (NYSE:BAC)

Follow Bank Of America Corp (NYSE:BAC)

Receive real-time insider trading and news alerts

If you’d ask most shareholders, hedge funds are perceived as worthless, old investment tools of yesteryear. While there are greater than 8000 funds trading at the moment, Our experts choose to focus on the crème de la crème of this club, around 700 funds. It is estimated that this group of investors watch over most of the hedge fund industry’s total capital, and by tailing their first-class investments, Insider Monkey has brought to light numerous investment strategies that have historically beaten the broader indices. Insider Monkey’s small-cap hedge fund strategy outstripped the S&P 500 index by 12 percentage points per year for a decade in their back tests.

Copyright: agcreativelab / 123RF Stock Photo

Now, we’re going to view the key action surrounding Bank of America Corp (NYSE:BAC).

Hedge fund activity in Bank of America Corp (NYSE:BAC)

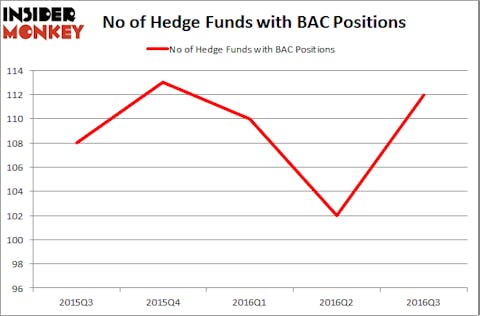

Heading into the fourth quarter of 2016, a total of 112 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from one quarter earlier. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Boykin Curry’s Eagle Capital Management has the largest position in Bank of America Corp (NYSE:BAC), worth close to $571.5 million, corresponding to 2.5% of its total 13F portfolio. The second most bullish fund manager is Ken Fisher of Fisher Asset Management, with a $559.6 million position; 1% of its 13F portfolio is allocated to the stock. Other peers that are bullish include Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC, Richard S. Pzena’s Pzena Investment Management, and Andreas Halvorsen’s Viking Global.