Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. Global markets saw an incredible but volatile second quarter, shifting from deep declines to strong gains. In the quarter, its Investor Class fund ARTSX returned 7.30%, Advisor Class fund APDSX posted a return of 7.33%, and Institutional Class fund APHSX returned 7.36%, compared to a return of 11.97% for the Russell 2000 Growth Index. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2025.

In its second-quarter 2025 investor letter, Artisan Small Cap Fund highlighted stocks such as MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI). MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) manufactures analog semiconductor solutions for wireless and wireline applications. The one-month return of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) was -10.23%, and its shares gained 15.50% of their value over the last 52 weeks. On August 21, 2025, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) stock closed at $123.58 per share, with a market capitalization of $9.203 billion.

Artisan Small Cap Fund stated the following regarding MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in its second quarter 2025 investor letter:

“Among our top Q2 contributors were Flex, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) and iRhythm. MACOM designs and manufactures high-performance semiconductors. The company has been taking steps to accelerate top-line growth and expand margins by addressing smaller, long duration product cycle markets in which it can provide a differentiated offering, especially in compound semis (those made from two or more elements). Demand remains strong across MACOM’s key end markets, including US and European defense, data center and even telecom—spanning both long-haul and satellite segments. Moreover, MACOM’s above-average semiconductor production footprint within the US likely reduces its exposure to potential industrywide disruptions related to any potential tariff risks.”

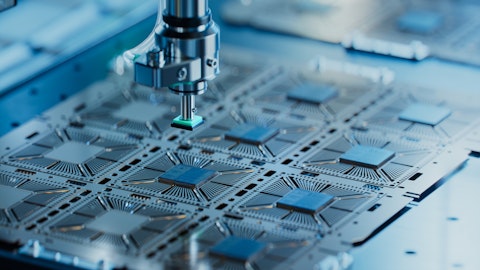

An aerial view of a semiconductor factory, with its intricate machinery and equipment.

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 34 hedge fund portfolios held MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) at the end of the second quarter, which was 36 in the previous quarter. In the second quarter of 2025, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) reported record revenue of $235.9 million, representing an 8.1% sequential growth. While we acknowledge the risk and potential of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) and shared the list of must-buy semiconductor stocks to invest in. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.