Brown Advisory, an investment management company, released its “Brown Advisory Large-Cap Growth Strategy” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The strategy returned -0.88% (net) during the third quarter, underperforming the benchmark, the Russell 1000 Growth Index. Even though the portfolio has significant exposure to AI, its underweight to the most speculative momentum-driven parts of the trade was a headwind to performance. In addition, please check the fund’s top five holdings to know its best picks in 2025.

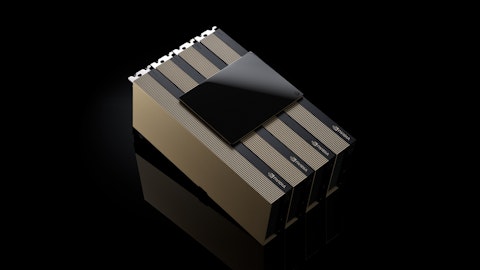

In its third-quarter 2025 investor letter, Brown Advisory Large-Cap Growth Strategy highlighted stocks such as NVIDIA Corporation (NASDAQ:NVDA). NVIDIA Corporation (NASDAQ:NVDA) offers graphics, compute, and networking solutions. The one-month return for NVIDIA Corporation (NASDAQ:NVDA) was -4.52%, and its shares gained 23.80% over the last 52 weeks. On December 03, 2025, NVIDIA Corporation (NASDAQ:NVDA) stock closed at $179.59 per share, with a market capitalization of $4.37 trillion.

Brown Advisory Large-Cap Growth Strategy stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its third quarter 2025 investor letter:

“NVIDIA Corporation (NASDAQ:NVDA), a market leader in advanced graphics processing units, continued its rally for the second consecutive quarter, rebounding more than 90% from its April lows. The stock’s strength was driven by earnings that exceeded consensus expectations and improving gross margin guidance, as Blackwell rack yields continued to improve. Additional momentum came from new strategic partnerships and a recovery from earlier-year weakness tied to the DeepSeek demand scare, which had pressured AI infrastructure stocks broadly.”

NVIDIA Corporation (NASDAQ:NVDA) is in 5th position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 234 hedge fund portfolios held NVIDIA Corporation (NASDAQ:NVDA) at the end of the second quarter, compared to 235 in the previous quarter. In the third quarter of fiscal 2026, NVIDIA Corporation (NASDAQ:NVDA) reported $57 billion in revenues, marking a 62% year over year growth. While we acknowledge the risk and potential of NVIDIA Corporation (NASDAQ:NVDA) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than NVIDIA Corporation (NASDAQ:NVDA) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered NVIDIA Corporation (NASDAQ:NVDA) and shared the list of best augmented reality stocks to buy. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.