Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Valvoline Inc (NYSE:VVV).

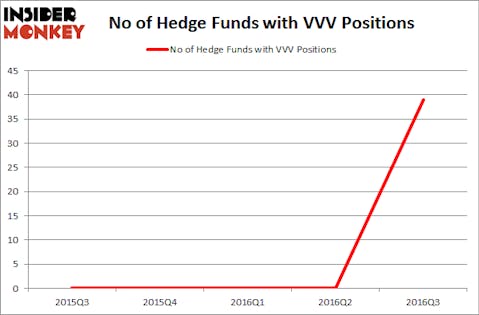

Valvoline Inc (NYSE:VVV) was in 39 hedge funds’ portfolios at the end of the third quarter of 2016 after going public on September 23. The level of hedge fund ownership is not the only variable you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Booz Allen Hamilton Holding Corporation (NYSE:BAH), Edgewell Personal Care Company (NYSE:EPC), and Tegna Inc (NYSE:TGNA) to gather more data points.

Follow Valvoline Inc (NYSE:VVV)

Follow Valvoline Inc (NYSE:VVV)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

JNP/Shutterstock.com

How have hedgies been trading Valvoline Inc (NYSE:VVV)?

Heading into the fourth quarter of 2016, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock. That’s an impressive push into a small-cap stock in the one week the company was public in the third quarter. Overall, hedge funds in our system owned 6.60% of Valvoline’s shares on September 30. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Daniel S. Och’s OZ Management has the number one position in Valvoline Inc (NYSE:VVV), worth close to $29.5 million. Coming in second is Israel Englander’s Millennium Management holding a $28.3 million position.

With general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Some of the other funds with new positions in the stock are Jeff Lignelli’s Incline Global Management, Barry Rosenstein’s JANA Partners, and Matthew Knauer and Mina Faltas’ Nokota Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Valvoline Inc (NYSE:VVV) but similarly valued. These stocks are Booz Allen Hamilton Holding Corporation (NYSE:BAH), Edgewell Personal Care Company (NYSE:EPC), Tegna Inc (NYSE:TGNA), and QEP Resources Inc (NYSE:QEP). This group of stocks’ market caps are similar to VVV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAH | 23 | 290165 | -4 |

| EPC | 25 | 509443 | -7 |

| TGNA | 22 | 515673 | 4 |

| QEP | 31 | 527550 | -3 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $461 million. That figure was $310 million in VVV’s case. QEP Resources Inc (NYSE:QEP) is the most popular stock in this table. On the other hand Tegna Inc (NYSE:TGNA) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Valvoline Inc (NYSE:VVV) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None