Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Global Payments Inc (NYSE:GPN)? The smart money sentiment can provide an answer to this question.

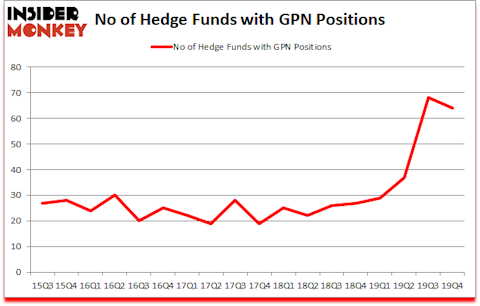

Global Payments Inc (NYSE:GPN) was in 64 hedge funds’ portfolios at the end of December. GPN shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. There were 68 hedge funds in our database with GPN holdings at the end of the previous quarter. Our calculations also showed that GPN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are many metrics stock traders use to grade publicly traded companies. Two of the most useful metrics are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the top hedge fund managers can outclass their index-focused peers by a significant margin (see the details here).

Stephen Mandel of Lone Pine Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now let’s go over the recent hedge fund action regarding Global Payments Inc (NYSE:GPN).

How are hedge funds trading Global Payments Inc (NYSE:GPN)?

At the end of the fourth quarter, a total of 64 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GPN over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Lone Pine Capital, holds the most valuable position in Global Payments Inc (NYSE:GPN). Lone Pine Capital has a $592.4 million position in the stock, comprising 3.1% of its 13F portfolio. Coming in second is Citadel Investment Group, managed by Ken Griffin, which holds a $464.1 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism include Philippe Laffont’s Coatue Management, Panayotis Takis Sparaggis’s Alkeon Capital Management and Robert Pitts’s Steadfast Capital Management. In terms of the portfolio weights assigned to each position Joho Capital allocated the biggest weight to Global Payments Inc (NYSE:GPN), around 19.05% of its 13F portfolio. Caldera Capital is also relatively very bullish on the stock, setting aside 17.62 percent of its 13F equity portfolio to GPN.

Because Global Payments Inc (NYSE:GPN) has faced declining sentiment from hedge fund managers, it’s safe to say that there is a sect of funds who sold off their entire stakes last quarter. It’s worth mentioning that D. E. Shaw’s D E Shaw dropped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $27.6 million in stock. Charles Clough’s fund, Clough Capital Partners, also said goodbye to its stock, about $17.1 million worth. These moves are important to note, as aggregate hedge fund interest fell by 4 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Global Payments Inc (NYSE:GPN) but similarly valued. We will take a look at Deere & Company (NYSE:DE), The Sherwin-Williams Company (NYSE:SHW), Biogen Inc. (NASDAQ:BIIB), and Advanced Micro Devices, Inc. (NASDAQ:AMD). This group of stocks’ market valuations resemble GPN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DE | 50 | 1403325 | 9 |

| SHW | 55 | 1847137 | 4 |

| BIIB | 61 | 5162729 | 8 |

| AMD | 53 | 1462695 | -6 |

| Average | 54.75 | 2468972 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54.75 hedge funds with bullish positions and the average amount invested in these stocks was $2469 million. That figure was $4064 million in GPN’s case. Biogen Inc. (NASDAQ:BIIB) is the most popular stock in this table. On the other hand Deere & Company (NYSE:DE) is the least popular one with only 50 bullish hedge fund positions. Compared to these stocks Global Payments Inc (NYSE:GPN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on GPN as the stock returned 5.4% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.