Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

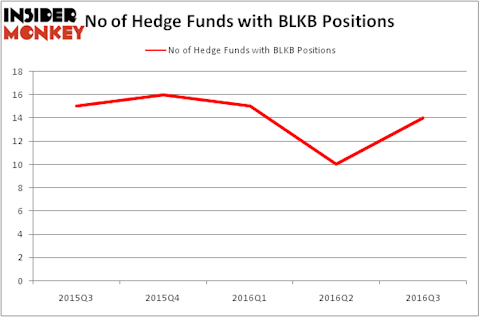

Is Blackbaud, Inc. (NASDAQ:BLKB) a healthy stock for your portfolio? The smart money is in a bullish mood. The number of long hedge fund positions improved by 4 lately. BLKB was in 14 hedge funds’ portfolios at the end of the third quarter of 2016. There were 10 hedge funds in our database with BLKB holdings at the end of the second quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Eldorado Gold Corp (USA) (NYSE:EGO), Rayonier Inc. (NYSE:RYN), and Urban Outfitters, Inc. (NASDAQ:URBN) to gather more data points.

Follow Blackbaud Inc (NASDAQ:BLKB)

Follow Blackbaud Inc (NASDAQ:BLKB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

andriano.cz/Shutterstock.com

What does the smart money think about Blackbaud, Inc. (NASDAQ:BLKB)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 40% jump from the previous quarter. The graph below displays the number of hedge funds with bullish position in BLKB over the last 5 quarters, which shows that ownership is still down slightly this year, despite the Q3 surge. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Select Equity Group, led by Robert Joseph Caruso, holds the number one position in Blackbaud, Inc. (NASDAQ:BLKB). Select Equity Group has a $50.6 million position in the stock. Coming in second is RGM Capital, led by Robert G. Moses, which holds a $39.6 million position; the fund has 4.5% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish encompass Chuck Royce’s Royce & Associates, John Kim’s Night Owl Capital Management, and Jim Simons’ Renaissance Technologies. We should note that RGM Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industry-wide interest jumped, key hedge funds have jumped into Blackbaud, Inc. (NASDAQ:BLKB) headfirst. Night Owl Capital Management created the most valuable position in Blackbaud, Inc. (NASDAQ:BLKB). Night Owl Capital Management had $4.7 million invested in the company at the end of the quarter. George Hall’s Clinton Group also initiated a $3.2 million position during the quarter. The other funds with brand new BLKB positions are Ken Griffin’s Citadel Investment Group, Matthew Tewksbury’s Stevens Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Blackbaud, Inc. (NASDAQ:BLKB) but similarly valued. We will take a look at Eldorado Gold Corp (USA) (NYSE:EGO), Rayonier Inc. (NYSE:RYN), Urban Outfitters, Inc. (NASDAQ:URBN), and Take-Two Interactive Software, Inc. (NASDAQ:TTWO). This group of stocks’ market caps match BLKB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGO | 19 | 111699 | 0 |

| RYN | 15 | 346535 | 5 |

| URBN | 25 | 271624 | 0 |

| TTWO | 46 | 1228866 | -1 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $490 million. That figure was $127 million in BLKB’s case. Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is the most popular stock in this table. On the other hand Rayonier Inc. (NYSE:RYN) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Blackbaud, Inc. (NASDAQ:BLKB) is even less popular than RYN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None