We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether The Travelers Companies, Inc. (NYSE:TRV) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

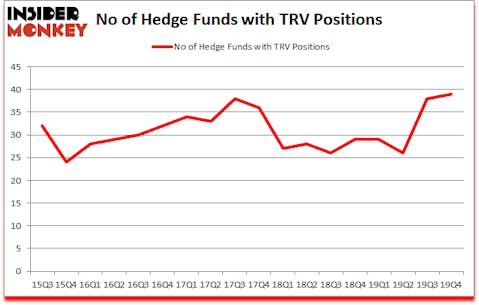

The Travelers Companies, Inc. (NYSE:TRV) shareholders have witnessed an increase in hedge fund interest of late. Our calculations also showed that TRV isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are seen as unimportant, old financial vehicles of the past. While there are over 8000 funds with their doors open today, We choose to focus on the bigwigs of this club, about 850 funds. These investment experts handle bulk of all hedge funds’ total capital, and by keeping track of their highest performing investments, Insider Monkey has uncovered a number of investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s review the key hedge fund action encompassing The Travelers Companies, Inc. (NYSE:TRV).

What have hedge funds been doing with The Travelers Companies, Inc. (NYSE:TRV)?

Heading into the first quarter of 2020, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the third quarter of 2019. Below, you can check out the change in hedge fund sentiment towards TRV over the last 18 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the largest position in The Travelers Companies, Inc. (NYSE:TRV). AQR Capital Management has a $347.5 million position in the stock, comprising 0.4% of its 13F portfolio. Coming in second is Citadel Investment Group, managed by Ken Griffin, which holds a $163.1 million position; 0.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish contain Brian Ashford-Russell and Tim Woolley’s Polar Capital, Dmitry Balyasny’s Balyasny Asset Management and Tom Gayner’s Markel Gayner Asset Management. In terms of the portfolio weights assigned to each position Voleon Capital allocated the biggest weight to The Travelers Companies, Inc. (NYSE:TRV), around 1.03% of its 13F portfolio. Arjuna Capital is also relatively very bullish on the stock, earmarking 0.94 percent of its 13F equity portfolio to TRV.

As one would reasonably expect, key hedge funds were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the biggest position in The Travelers Companies, Inc. (NYSE:TRV). Balyasny Asset Management had $57.5 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $33.4 million investment in the stock during the quarter. The following funds were also among the new TRV investors: Michael Kharitonov and Jon David McAuliffe’s Voleon Capital, Renaissance Technologies, and Matthew L Pinz’s Pinz Capital.

Let’s go over hedge fund activity in other stocks similar to The Travelers Companies, Inc. (NYSE:TRV). These stocks are Canadian Pacific Railway Limited (NYSE:CP), Carnival Corporation & Plc (NYSE:CCL), Energy Transfer L.P. (NYSE:ET), and Monster Beverage Corp (NASDAQ:MNST). This group of stocks’ market caps are similar to TRV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CP | 29 | 1760164 | -4 |

| CCL | 34 | 895329 | 4 |

| ET | 36 | 718963 | 2 |

| MNST | 45 | 3533015 | 9 |

| Average | 36 | 1726868 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $1727 million. That figure was $906 million in TRV’s case. Monster Beverage Corp (NASDAQ:MNST) is the most popular stock in this table. On the other hand Canadian Pacific Railway Limited (NYSE:CP) is the least popular one with only 29 bullish hedge fund positions. The Travelers Companies, Inc. (NYSE:TRV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but beat the market by 3.1 percentage points. Unfortunately TRV wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TRV were disappointed as the stock returned -17.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.