You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

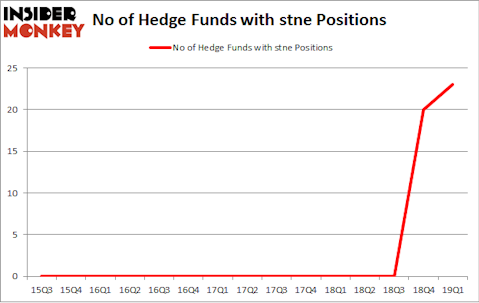

Is StoneCo Ltd. (NASDAQ:STNE) worth your attention right now? The best stock pickers are turning bullish. The number of bullish hedge fund positions rose by 3 in recent months. Our calculations also showed that stne isn’t among the 30 most popular stocks among hedge funds. STNE was in 23 hedge funds’ portfolios at the end of March. There were 20 hedge funds in our database with STNE holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are a lot of gauges stock market investors put to use to grade their holdings. Some of the most innovative gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top money managers can beat the broader indices by a healthy margin (see the details here).

Let’s take a glance at the latest hedge fund action surrounding StoneCo Ltd. (NASDAQ:STNE).

What does the smart money think about StoneCo Ltd. (NASDAQ:STNE)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in STNE a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of StoneCo Ltd. (NASDAQ:STNE), with a stake worth $582.4 million reported as of the end of March. Trailing Berkshire Hathaway was Tiger Global Management, which amassed a stake valued at $435.7 million. Steadfast Capital Management, Discovery Capital Management, and Whale Rock Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have been driving this bullishness. Whale Rock Capital Management, managed by Alex Sacerdote, assembled the most outsized position in StoneCo Ltd. (NASDAQ:STNE). Whale Rock Capital Management had $147.2 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also initiated a $13.4 million position during the quarter. The other funds with brand new STNE positions are Leon Shaulov’s Maplelane Capital, Ken Griffin’s Citadel Investment Group, and Jeffrey Hoffner’s Engle Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as StoneCo Ltd. (NASDAQ:STNE) but similarly valued. These stocks are E*TRADE Financial Corporation (NASDAQ:ETFC), Raymond James Financial, Inc. (NYSE:RJF), Regency Centers Corp (NASDAQ:REG), and Zebra Technologies Corporation (NASDAQ:ZBRA). This group of stocks’ market valuations are closest to STNE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETFC | 43 | 1473468 | 2 |

| RJF | 35 | 794772 | 10 |

| REG | 17 | 397323 | 2 |

| ZBRA | 35 | 1101221 | 6 |

| Average | 32.5 | 941696 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $942 million. That figure was $1735 million in STNE’s case. E*TRADE Financial Corporation (NASDAQ:ETFC) is the most popular stock in this table. On the other hand Regency Centers Corp (NASDAQ:REG) is the least popular one with only 17 bullish hedge fund positions. StoneCo Ltd. (NASDAQ:STNE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately STNE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); STNE investors were disappointed as the stock returned -38% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.