Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

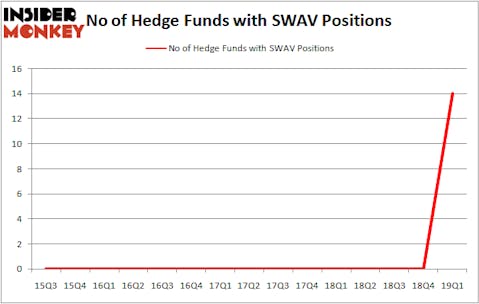

Is ShockWave Medical, Inc. (NASDAQ:SWAV) an attractive investment right now? Hedge funds are getting more optimistic. The number of long hedge fund bets increased by 14 lately. Our calculations also showed that SWAV isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action encompassing ShockWave Medical, Inc. (NASDAQ:SWAV).

What does smart money think about ShockWave Medical, Inc. (NASDAQ:SWAV)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14 from the fourth quarter of 2018. By comparison, 0 hedge funds held shares or bullish call options in SWAV a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ShockWave Medical, Inc. (NASDAQ:SWAV) was held by Sectoral Asset Management, which reported holding $28.4 million worth of stock at the end of March. It was followed by RA Capital Management with a $16.6 million position. Other investors bullish on the company included Deerfield Management, Redmile Group, and Citadel Investment Group.

Now, key hedge funds have jumped into ShockWave Medical, Inc. (NASDAQ:SWAV) headfirst. Sectoral Asset Management, managed by Jerome Pfund and Michael Sjostrom, initiated the most outsized position in ShockWave Medical, Inc. (NASDAQ:SWAV). Sectoral Asset Management had $28.4 million invested in the company at the end of the quarter. Peter Kolchinsky’s RA Capital Management also initiated a $16.6 million position during the quarter. The other funds with brand new SWAV positions are James E. Flynn’s Deerfield Management, Jeremy Green’s Redmile Group, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to ShockWave Medical, Inc. (NASDAQ:SWAV). We will take a look at Quotient Technology Inc (NYSE:QUOT), Sturm, Ruger & Company, Inc. (NYSE:RGR), Genfit SA (NASDAQ:GNFT), and InfraREIT, Inc. (REIT) (NYSE:HIFR). This group of stocks’ market caps are closest to SWAV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QUOT | 16 | 228016 | 4 |

| RGR | 17 | 110759 | 3 |

| GNFT | 10 | 90626 | 10 |

| HIFR | 14 | 190869 | -1 |

| Average | 14.25 | 155068 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $98 million in SWAV’s case. Sturm, Ruger & Company, Inc. (NYSE:RGR) is the most popular stock in this table. On the other hand Genfit SA (NASDAQ:GNFT) is the least popular one with only 10 bullish hedge fund positions. ShockWave Medical, Inc. (NASDAQ:SWAV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on SWAV as the stock returned 76.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.