The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards SailPoint Technologies Holdings, Inc. (NYSE:SAIL).

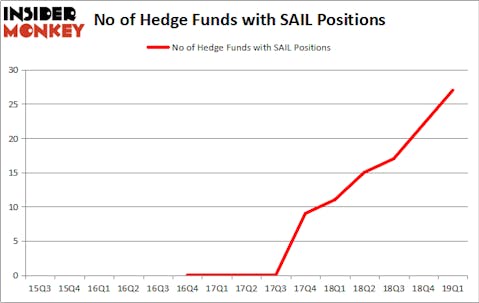

Is SailPoint Technologies Holdings, Inc. (NYSE:SAIL) a marvelous stock to buy now? Investors who are in the know are getting more optimistic. The number of long hedge fund positions inched up by 5 lately. Our calculations also showed that SAIL isn’t among the 30 most popular stocks among hedge funds. SAIL was in 27 hedge funds’ portfolios at the end of March. There were 22 hedge funds in our database with SAIL holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are viewed as worthless, outdated financial vehicles of the past. While there are more than 8000 funds with their doors open at present, Our experts hone in on the leaders of this club, around 750 funds. It is estimated that this group of investors oversee most of the smart money’s total asset base, and by tailing their inimitable equity investments, Insider Monkey has unearthed many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a look at the recent hedge fund action regarding SailPoint Technologies Holdings, Inc. (NYSE:SAIL).

Hedge fund activity in SailPoint Technologies Holdings, Inc. (NYSE:SAIL)

Heading into the second quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 23% from the fourth quarter of 2018. By comparison, 11 hedge funds held shares or bullish call options in SAIL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in SailPoint Technologies Holdings, Inc. (NYSE:SAIL) was held by Jericho Capital Asset Management, which reported holding $70.4 million worth of stock at the end of March. It was followed by Point72 Asset Management with a $45.3 million position. Other investors bullish on the company included Citadel Investment Group, Millennium Management, and Sandler Capital Management.

With a general bullishness amongst the heavyweights, some big names have jumped into SailPoint Technologies Holdings, Inc. (NYSE:SAIL) headfirst. Jericho Capital Asset Management, managed by Josh Resnick, established the most outsized position in SailPoint Technologies Holdings, Inc. (NYSE:SAIL). Jericho Capital Asset Management had $70.4 million invested in the company at the end of the quarter. Peter S. Park’s Park West Asset Management also made a $12.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Cliff Asness’s AQR Capital Management, Zach Schreiber’s Point State Capital, and D. E. Shaw’s D E Shaw.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as SailPoint Technologies Holdings, Inc. (NYSE:SAIL) but similarly valued. We will take a look at Companhia Paranaense de Energia (NYSE:ELP), Southwestern Energy Company (NYSE:SWN), Colliers International Group Inc (NASDAQ:CIGI), and Akcea Therapeutics, Inc. (NASDAQ:AKCA). This group of stocks’ market caps resemble SAIL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELP | 10 | 52781 | 2 |

| SWN | 24 | 270841 | -1 |

| CIGI | 14 | 670696 | 1 |

| AKCA | 7 | 27613 | 1 |

| Average | 13.75 | 255483 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $259 million in SAIL’s case. Southwestern Energy Company (NYSE:SWN) is the most popular stock in this table. On the other hand Akcea Therapeutics, Inc. (NASDAQ:AKCA) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks SailPoint Technologies Holdings, Inc. (NYSE:SAIL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SAIL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SAIL were disappointed as the stock returned -38.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.