“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

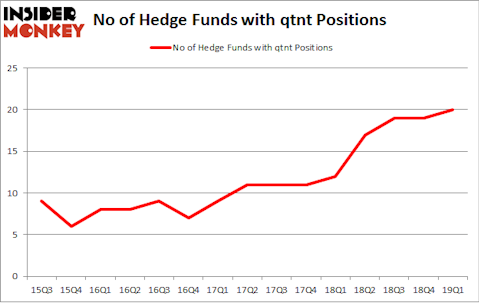

Quotient Limited (NASDAQ:QTNT) investors should pay attention to an increase in enthusiasm from smart money lately. QTNT was in 20 hedge funds’ portfolios at the end of the first quarter of 2019. There were 19 hedge funds in our database with QTNT holdings at the end of the previous quarter. Our calculations also showed that qtnt isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are seen as worthless, old financial vehicles of the past. While there are more than 8000 funds trading at the moment, Our experts choose to focus on the masters of this club, approximately 750 funds. These investment experts handle the lion’s share of all hedge funds’ total capital, and by observing their top stock picks, Insider Monkey has brought to light a number of investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Sander Gerber of Hudson Bay Capital

Let’s take a look at the fresh hedge fund action encompassing Quotient Limited (NASDAQ:QTNT).

What have hedge funds been doing with Quotient Limited (NASDAQ:QTNT)?

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from the fourth quarter of 2018. On the other hand, there were a total of 12 hedge funds with a bullish position in QTNT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Polar Capital held the most valuable stake in Quotient Limited (NASDAQ:QTNT), which was worth $57.2 million at the end of the first quarter. On the second spot was Cormorant Asset Management which amassed $41.4 million worth of shares. Moreover, Highbridge Capital Management, Broadfin Capital, and Hudson Bay Capital Management were also bullish on Quotient Limited (NASDAQ:QTNT), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, created the most valuable position in Quotient Limited (NASDAQ:QTNT). Citadel Investment Group had $2.1 million invested in the company at the end of the quarter. Efrem Kamen’s Pura Vida Investments also made a $2 million investment in the stock during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Jim Simons’s Renaissance Technologies.

Let’s check out hedge fund activity in other stocks similar to Quotient Limited (NASDAQ:QTNT). These stocks are SurModics, Inc. (NASDAQ:SRDX), FutureFuel Corp. (NYSE:FF), Plug Power, Inc. (NASDAQ:PLUG), and Mobileiron Inc (NASDAQ:MOBL). This group of stocks’ market caps are similar to QTNT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRDX | 17 | 128689 | 0 |

| FF | 15 | 53636 | 1 |

| PLUG | 7 | 43583 | 1 |

| MOBL | 17 | 126183 | 1 |

| Average | 14 | 88023 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $166 million in QTNT’s case. SurModics, Inc. (NASDAQ:SRDX) is the most popular stock in this table. On the other hand Plug Power, Inc. (NASDAQ:PLUG) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Quotient Limited (NASDAQ:QTNT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on QTNT as the stock returned 11.8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.