Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Pluralsight, Inc. (NASDAQ:PS).

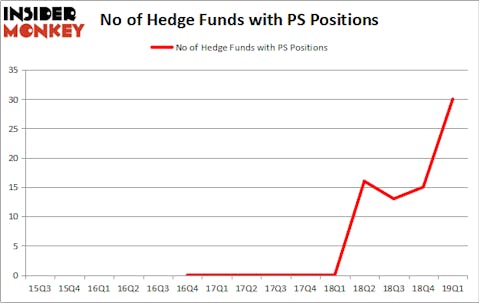

Pluralsight, Inc. (NASDAQ:PS) investors should be aware of an increase in support from the world’s most elite money managers in recent months. PS was in 30 hedge funds’ portfolios at the end of the first quarter of 2019. There were 15 hedge funds in our database with PS holdings at the end of the previous quarter. Our calculations also showed that PS isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a peek at the recent hedge fund action encompassing Pluralsight, Inc. (NASDAQ:PS).

What have hedge funds been doing with Pluralsight, Inc. (NASDAQ:PS)?

Heading into the second quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 100% from the fourth quarter of 2018. By comparison, 0 hedge funds held shares or bullish call options in PS a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Whale Rock Capital Management held the most valuable stake in Pluralsight, Inc. (NASDAQ:PS), which was worth $64.8 million at the end of the first quarter. On the second spot was D E Shaw which amassed $30.1 million worth of shares. Moreover, Engle Capital, Hitchwood Capital Management, and Two Sigma Advisors were also bullish on Pluralsight, Inc. (NASDAQ:PS), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, established the most valuable position in Pluralsight, Inc. (NASDAQ:PS). D E Shaw had $30.1 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also initiated a $25.4 million position during the quarter. The other funds with brand new PS positions are Anand Parekh’s Alyeska Investment Group, Philip Hilal’s Clearfield Capital, and Ken Grossman and Glen Schneider’s SG Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Pluralsight, Inc. (NASDAQ:PS) but similarly valued. These stocks are Compania de Minas Buenaventura SAA (NYSE:BVN), Landstar System, Inc. (NASDAQ:LSTR), Brunswick Corporation (NYSE:BC), and Southwest Gas Holdings, Inc. (NYSE:SWX). This group of stocks’ market valuations are similar to PS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BVN | 7 | 16483 | 1 |

| LSTR | 23 | 208696 | 0 |

| BC | 27 | 564907 | 1 |

| SWX | 20 | 207977 | 3 |

| Average | 19.25 | 249516 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $250 million. That figure was $321 million in PS’s case. Brunswick Corporation (NYSE:BC) is the most popular stock in this table. On the other hand Compania de Minas Buenaventura SAA (NYSE:BVN) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Pluralsight, Inc. (NASDAQ:PS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on PS as the stock returned 5.7% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.