Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Okta, Inc. (NASDAQ:OKTA).

Okta, Inc. (NASDAQ:OKTA) investors should be aware of an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that OKTA isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the key hedge fund action surrounding Okta, Inc. (NASDAQ:OKTA).

What have hedge funds been doing with Okta, Inc. (NASDAQ:OKTA)?

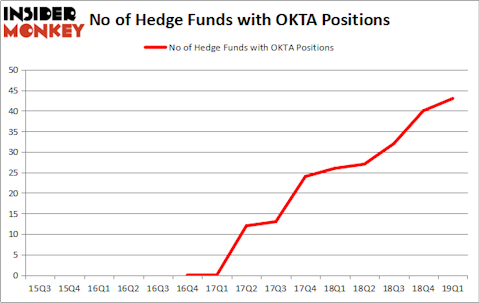

At the end of the first quarter, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OKTA over the last 15 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Panayotis Takis Sparaggis’s Alkeon Capital Management has the biggest position in Okta, Inc. (NASDAQ:OKTA), worth close to $161 million, amounting to 0.8% of its total 13F portfolio. The second most bullish fund manager is Whale Rock Capital Management, led by Alex Sacerdote, holding a $154.8 million position; 2.8% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish comprise Jim Simons’s Renaissance Technologies, Brandon Haley’s Holocene Advisors and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Holocene Advisors, managed by Brandon Haley, assembled the biggest position in Okta, Inc. (NASDAQ:OKTA). Holocene Advisors had $79.3 million invested in the company at the end of the quarter. Christopher Lyle’s SCGE Management also initiated a $29 million position during the quarter. The other funds with brand new OKTA positions are Philippe Laffont’s Coatue Management, Principal Global Investors’s Columbus Circle Investors, and Benjamin A. Smith’s Laurion Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Okta, Inc. (NASDAQ:OKTA) but similarly valued. We will take a look at Alliance Data Systems Corporation (NYSE:ADS), MarketAxess Holdings Inc. (NASDAQ:MKTX), Arconic Inc. (NYSE:ARNC), and EQT Midstream Partners LP (NYSE:EQM). This group of stocks’ market values are similar to OKTA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADS | 38 | 1907491 | -1 |

| MKTX | 15 | 218079 | -2 |

| ARNC | 34 | 2519979 | -12 |

| EQM | 8 | 65494 | 0 |

| Average | 23.75 | 1177761 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $1178 million. That figure was $996 million in OKTA’s case. Alliance Data Systems Corporation (NYSE:ADS) is the most popular stock in this table. On the other hand EQT Midstream Partners LP (NYSE:EQM) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Okta, Inc. (NASDAQ:OKTA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on OKTA as the stock returned 28.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.