We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Inter Parfums, Inc. (NASDAQ:IPAR).

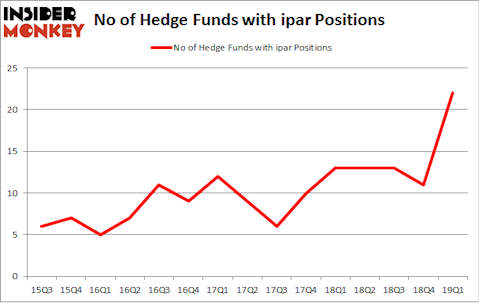

Is Inter Parfums, Inc. (NASDAQ:IPAR) a first-rate investment right now? The best stock pickers are in an optimistic mood. The number of long hedge fund bets rose by 11 recently. Our calculations also showed that ipar isn’t among the 30 most popular stocks among hedge funds. IPAR was in 22 hedge funds’ portfolios at the end of the first quarter of 2019. There were 11 hedge funds in our database with IPAR positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the key hedge fund action encompassing Inter Parfums, Inc. (NASDAQ:IPAR).

What does the smart money think about Inter Parfums, Inc. (NASDAQ:IPAR)?

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 100% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in IPAR over the last 15 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the number one position in Inter Parfums, Inc. (NASDAQ:IPAR). Royce & Associates has a $25.8 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Columbus Circle Investors, led by Principal Global Investors, holding a $17.5 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining peers that hold long positions contain Murray Stahl’s Horizon Asset Management, Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As industrywide interest jumped, key money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the largest position in Inter Parfums, Inc. (NASDAQ:IPAR). Arrowstreet Capital had $6.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $5.9 million position during the quarter. The following funds were also among the new IPAR investors: Richard Driehaus’s Driehaus Capital, Ken Griffin’s Citadel Investment Group, and Joel Greenblatt’s Gotham Asset Management.

Let’s now review hedge fund activity in other stocks similar to Inter Parfums, Inc. (NASDAQ:IPAR). We will take a look at Edgewell Personal Care Company (NYSE:EPC), Granite Real Estate Investment Trust (NYSE:GRP), Franklin Electric Co., Inc. (NASDAQ:FELE), and First Financial Bancorp (NASDAQ:FFBC). This group of stocks’ market caps match IPAR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPC | 19 | 179921 | 1 |

| GRP | 13 | 137058 | 2 |

| FELE | 15 | 232249 | 6 |

| FFBC | 8 | 19934 | 2 |

| Average | 13.75 | 142291 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $98 million in IPAR’s case. Edgewell Personal Care Company (NYSE:EPC) is the most popular stock in this table. On the other hand First Financial Bancorp (NASDAQ:FFBC) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Inter Parfums, Inc. (NASDAQ:IPAR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately IPAR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IPAR were disappointed as the stock returned -13.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.