Insider Monkey finished processing more than 738 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of March 31st, 2019. In this article we are going to take a look at smart money sentiment towards Fair Isaac Corporation (NYSE:FICO).

Fair Isaac Corporation (NYSE:FICO) has experienced an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that FICO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the latest hedge fund action encompassing Fair Isaac Corporation (NYSE:FICO).

How are hedge funds trading Fair Isaac Corporation (NYSE:FICO)?

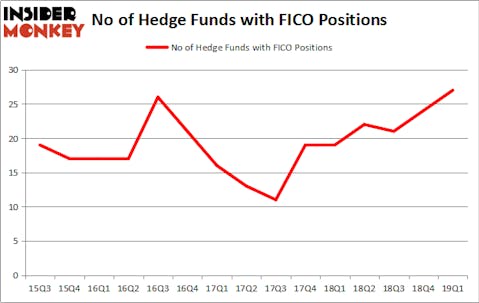

At Q1’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FICO over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Fair Isaac Corporation (NYSE:FICO) was held by Newbrook Capital Advisors, which reported holding $128.7 million worth of stock at the end of March. It was followed by AQR Capital Management with a $83 million position. Other investors bullish on the company included Royce & Associates, Ariel Investments, and GLG Partners.

Now, key money managers have been driving this bullishness. Newbrook Capital Advisors, managed by Robert Boucai, assembled the largest position in Fair Isaac Corporation (NYSE:FICO). Newbrook Capital Advisors had $128.7 million invested in the company at the end of the quarter. Per Johanssoná’s Bodenholm Capital also made a $31 million investment in the stock during the quarter. The following funds were also among the new FICO investors: Brian Ashford-Russell and Tim Woolley’s Polar Capital, Christopher James’s Partner Fund Management, and Philip Hilal’s Clearfield Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Fair Isaac Corporation (NYSE:FICO) but similarly valued. These stocks are Lamar Advertising Co (NASDAQ:LAMR), BeiGene, Ltd. (NASDAQ:BGNE), Steel Dynamics, Inc. (NASDAQ:STLD), and Tyler Technologies, Inc. (NYSE:TYL). All of these stocks’ market caps resemble FICO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LAMR | 20 | 249583 | -2 |

| BGNE | 15 | 1822583 | 0 |

| STLD | 27 | 405696 | -3 |

| TYL | 31 | 697752 | 7 |

| Average | 23.25 | 793904 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $794 million. That figure was $601 million in FICO’s case. Tyler Technologies, Inc. (NYSE:TYL) is the most popular stock in this table. On the other hand BeiGene, Ltd. (NASDAQ:BGNE) is the least popular one with only 15 bullish hedge fund positions. Fair Isaac Corporation (NYSE:FICO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on FICO as the stock returned 9.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey