Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (see the details). So, how do we invest in this environment? Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Alphabet Inc (NASDAQ:GOOGL)? The smart money sentiment can provide an answer to this question.

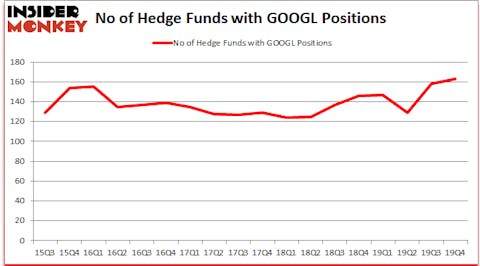

Alphabet Inc (NASDAQ:GOOGL) was in 163 hedge funds’ portfolios at the end of December. GOOGL investors should be aware of an increase in hedge fund sentiment recently. There were 158 hedge funds in our database with GOOGL positions at the end of the previous quarter. Our calculations also showed that GOOGL ranked 5th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. We read hedge fund investor letters, listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out recommendations of services with hard to believe track records. Last month, we recommended a long position in one of the most shorted stocks in the market. No, our recommendation wasn’t Tesla (TSLA). It was a better pick than Tesla as this stock gained nearly 50% in 3 weeks.

Keeping this in mind we’re going to take a glance at the key hedge fund action surrounding Alphabet Inc (NASDAQ:GOOGL).

How are hedge funds trading Alphabet Inc (NASDAQ:GOOGL)?

At Q4’s end, a total of 163 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the previous quarter. By comparison, 146 hedge funds held shares or bullish call options in GOOGL a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Fisher Asset Management held the most valuable stake in Alphabet Inc (NASDAQ:GOOGL), which was worth $1967.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $1645.8 million worth of shares. AQR Capital Management, Diamond Hill Capital, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Thunderbird Partners allocated the biggest weight to Alphabet Inc (NASDAQ:GOOGL), around 29.47% of its 13F portfolio. Blacksheep Fund Management is also relatively very bullish on the stock, earmarking 28.64 percent of its 13F equity portfolio to GOOGL.

Consequently, key hedge funds were leading the bulls’ herd. AltaRock Partners, managed by Mark Massey, established the largest position in Alphabet Inc (NASDAQ:GOOGL). AltaRock Partners had $308.1 million invested in the company at the end of the quarter. Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management also made a $144.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Chase Coleman’s Tiger Global Management LLC, Stanley Druckenmiller’s Duquesne Capital, and Andrew Hahn’s Ursa Fund Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Alphabet Inc (NASDAQ:GOOGL) but similarly valued. We will take a look at Alphabet Inc (NASDAQ:GOOG), Amazon.com, Inc. (NASDAQ:AMZN), Facebook Inc (NASDAQ:FB), and Alibaba Group Holding Limited (NYSE:BABA). This group of stocks’ market values resemble GOOGL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GOOG | 148 | 16215698 | 0 |

| AMZN | 202 | 28001232 | 21 |

| FB | 198 | 24395049 | 6 |

| BABA | 170 | 22442887 | 10 |

| Average | 179.5 | 22763717 | 9.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 179.5 hedge funds with bullish positions and the average amount invested in these stocks was $22.8 billion. That figure was $13.1 billion in GOOGL’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Alphabet Inc (NASDAQ:GOOG) is the least popular one with only 148 bullish hedge fund positions. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on GOOGL as the stock returned 3.5% during the same time period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.