Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by more than 6 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Linde plc (NYSE:LIN) from the perspective of those elite funds.

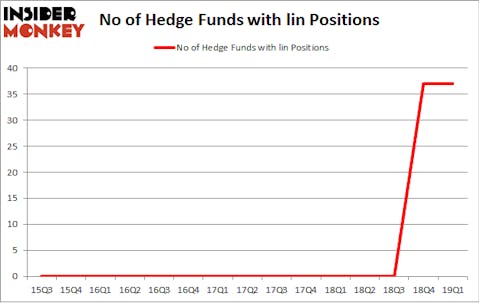

Linde plc (NYSE:LIN) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 37 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as British American Tobacco plc (NYSEAMEX:BTI), Danaher Corporation (NYSE:DHR), and Starbucks Corporation (NASDAQ:SBUX) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to take a look at the latest hedge fund action encompassing Linde plc (NYSE:LIN).

How have hedgies been trading Linde plc (NYSE:LIN)?

Heading into the second quarter of 2019, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in LIN a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Steadfast Capital Management was the largest shareholder of Linde plc (NYSE:LIN), with a stake worth $252.9 million reported as of the end of March. Trailing Steadfast Capital Management was Polaris Capital Management, which amassed a stake valued at $220.9 million. Diamond Hill Capital, AQR Capital Management, and Adage Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Linde plc (NYSE:LIN) has experienced falling interest from the smart money, we can see that there were a few funds who sold off their positions entirely by the end of the third quarter. At the top of the heap, John Armitage’s Egerton Capital Limited dumped the biggest position of all the hedgies tracked by Insider Monkey, worth an estimated $469.1 million in stock, and John Smith Clark’s Southpoint Capital Advisors was right behind this move, as the fund dumped about $101.4 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Linde plc (NYSE:LIN). These stocks are British American Tobacco plc (NYSE:BTI), Danaher Corporation (NYSE:DHR), Starbucks Corporation (NASDAQ:SBUX), and NextEra Energy, Inc. (NYSE:NEE). All of these stocks’ market caps resemble LIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTI | 15 | 316057 | 5 |

| DHR | 58 | 3081018 | 10 |

| SBUX | 47 | 4588018 | 5 |

| NEE | 36 | 857567 | -1 |

| Average | 39 | 2210665 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39 hedge funds with bullish positions and the average amount invested in these stocks was $2211 million. That figure was $1629 million in LIN’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSE:BTI) is the least popular one with only 15 bullish hedge fund positions. Linde plc (NYSE:LIN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on LIN as the stock returned 4.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.