Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

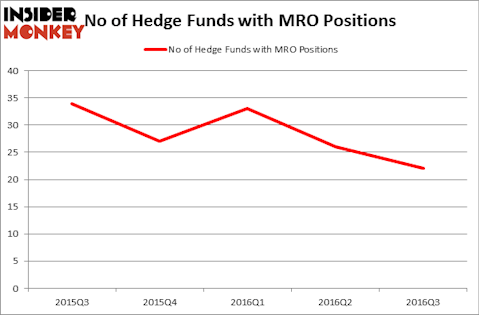

Marathon Oil Corporation (NYSE:MRO) has seen a decrease in activity from the world’s largest hedge funds lately. Hedge fund ownership of the stock has fallen by over 33% in the past year. At the end of this article we will also compare MRO to other stocks including National-Oilwell Varco, Inc. (NYSE:NOV), Macerich Co (NYSE:MAC), and Nomura Holdings, Inc. (ADR) (NYSE:NMR) to get a better sense of its popularity.

Follow Marathon Oil Corp (NYSE:MRO)

Follow Marathon Oil Corp (NYSE:MRO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

stockphoto mania/Shutterstock.com

How have hedgies been trading Marathon Oil Corporation (NYSE:MRO)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 15% fall from one quarter earlier, as hedge fund ownership of the stock continues to wilt. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, D E Shaw, founded by David E. Shaw, holds the number one position in Marathon Oil Corporation (NYSE:MRO). D E Shaw has a $48.3 million position in the stock. On D E Shaw’s heels is Alyeska Investment Group, led by Anand Parekh, holding a $44.5 million position. Remaining members of the smart money with similar optimism include Charles Clough’s Clough Capital Partners and Phill Gross and Robert Atchinson’s Adage Capital Management.