A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Whirlpool Corporation (NYSE:WHR) .

Whirlpool Corporation (NYSE:WHR) was in 34 hedge funds’ portfolios at the end of September. WHR has experienced a decrease in enthusiasm from smart money lately. There were 37 hedge funds in our database with WHR positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Agnico-Eagle Mines Limited (USA) (NYSE:AEM), WestRock Co (NYSE:WRK), and Ultrapar Participacoes SA (ADR) (NYSE:UGP) to gather more data points.

Follow Whirlpool Corp (NYSE:WHR)

Follow Whirlpool Corp (NYSE:WHR)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Andor Bujdoso/Shutterstock.com

With all of this in mind, we’re going to take a look at the fresh action regarding Whirlpool Corporation (NYSE:WHR).

What does the smart money think about Whirlpool Corporation (NYSE:WHR)?

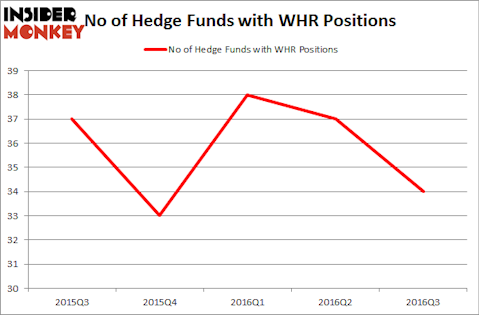

Heading into the fourth quarter of 2016, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 8% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WHR over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Greenhaven Associates, led by Edgar Wachenheim, holds the number one position in Whirlpool Corporation (NYSE:WHR). According to regulatory filings, the fund has a $424 million position in the stock, comprising 8.1% of its 13F portfolio. On Greenhaven Associates’s heels is Diamond Hill Capital, led by Ric Dillon, holding a $293.9 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Remaining peers that hold long positions consist of David Tepper’s Appaloosa Management LP, Cliff Asness’s AQR Capital Management and Ken Heebner’s Capital Growth Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Because Whirlpool Corporation (NYSE:WHR) has faced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedgies who were dropping their positions entirely heading into Q4. Interestingly, Anand Parekh’s Alyeska Investment Group sold off the largest position of the “upper crust” of funds watched by Insider Monkey, worth about $47.6 million in stock, and Bruce Kovner’s Caxton Associates LP was right behind this move, as the fund said goodbye to about $39.7 million worth of WHR shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Whirlpool Corporation (NYSE:WHR) but similarly valued. These stocks are Agnico-Eagle Mines Limited (USA) (NYSE:AEM), WestRock Co (NYSE:WRK), Ultrapar Participacoes SA (ADR) (NYSE:UGP), and Kimco Realty Corp (NYSE:KIM). All of these stocks’ market caps are closest to WHR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AEM | 25 | 500237 | -4 |

| WRK | 29 | 752003 | 4 |

| UGP | 10 | 87119 | 3 |

| KIM | 11 | 58251 | 4 |

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $349 million. That figure was $1.47 billion in WHR’s case. WestRock Co (NYSE:WRK) is the most popular stock in this table. On the other hand Ultrapar Participacoes SA (ADR) (NYSE:UGP) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Whirlpool Corporation (NYSE:WHR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.