We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Westar Energy Inc (NYSE:WR).

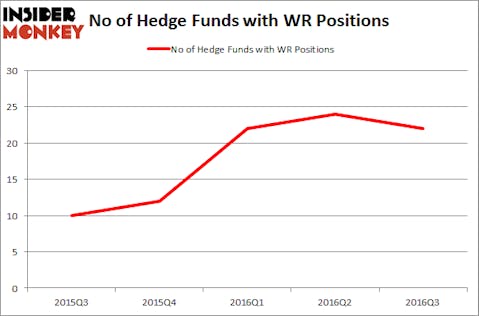

Westar Energy Inc (NYSE:WR) investors should be aware of a decrease in hedge fund sentiment of late. WR was in 22 hedge funds’ portfolios at the end of the third quarter of 2016. There were 24 hedge funds in our database with WR holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Brixmor Property Group Inc (NYSE:BRX), Huntington Ingalls Industries Inc (NYSE:HII), and Rite Aid Corporation (NYSE:RAD) to gather more data points.

Follow Westar Energy Inc (NYSE:WR)

Follow Westar Energy Inc (NYSE:WR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

chungking/Shutterstock.com

Now, we’re going to check out the key action regarding Westar Energy Inc (NYSE:WR).

What have hedge funds been doing with Westar Energy Inc (NYSE:WR)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 8% from the second quarter of 2016. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Phill Gross and Robert Atchinson’s Adage Capital Management has the biggest position in Westar Energy Inc (NYSE:WR), worth close to $161.1 million, corresponding to 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Eton Park Capital, led by Eric Mindich, holding a $116.7 million position; the fund has 2% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish include Alec Litowitz and Ross Laser’s Magnetar Capital, Israel Englander’s Millennium Management and Mario Gabelli’s GAMCO Investors.

Because Westar Energy Inc (NYSE:WR) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of hedge funds that decided to sell off their entire stakes last quarter. Intriguingly, John Orrico’s Water Island Capital dropped the largest stake of the “upper crust” of funds followed by Insider Monkey, valued at about $39.3 million in stock, and Thomas Steyer’s Farallon Capital was right behind this move, as the fund sold off about $13.6 million worth of WR shares. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Westar Energy Inc (NYSE:WR) but similarly valued. These stocks are Brixmor Property Group Inc (NYSE:BRX), Huntington Ingalls Industries Inc (NYSE:HII), Rite Aid Corporation (NYSE:RAD), and Varian Medical Systems, Inc. (NYSE:VAR). This group of stocks’ market caps resemble WR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRX | 17 | 166341 | -1 |

| HII | 32 | 600672 | 1 |

| RAD | 54 | 1302618 | 4 |

| VAR | 15 | 187765 | -2 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $564 million. That figure was $865 million in WR’s case. Rite Aid Corporation (NYSE:RAD) is the most popular stock in this table. On the other hand Varian Medical Systems, Inc. (NYSE:VAR) is the least popular one with only 15 bullish hedge fund positions. Westar Energy Inc (NYSE:WR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RAD might be a better candidate to consider a long position.

Disclosure: none.