We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article we look at what those investors think of MSC Industrial Direct Co Inc (NYSE:MSM).

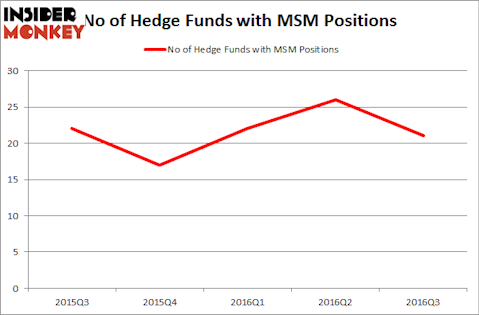

MSC Industrial Direct Co Inc (NYSE:MSM) has seen a decrease in enthusiasm from smart money lately. MSM was in 21 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with MSM holdings at the end of the previous quarter. At the end of this article we will also compare MSM to other stocks including DCT Industrial Trust Inc. (NYSE:DCT), Compania Cervecerias Unidas S.A. (ADR) (NYSE:CCU), and PTC Inc (NASDAQ:PTC) to get a better sense of its popularity.

Follow Msc Industrial Direct Co Inc (NYSE:MSM)

Follow Msc Industrial Direct Co Inc (NYSE:MSM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Photology1971/Shutterstock.com

What does the smart money think about MSC Industrial Direct Co Inc (NYSE:MSM)?

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 19% from one quarter earlier. Hedge fund ownership in MSM has been volatile over the past year, dipping to as few as 17 hedge fund shareholders at one point before rising more than 50% to 26 two quarters later. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the most valuable position in MSC Industrial Direct Co Inc (NYSE:MSM). Select Equity Group has a $126.5 million position in the stock, comprising 1.1% of its 13F portfolio. The second largest stake is held by Cantillon Capital Management, led by William von Mueffling, holding a $112 million position; 1.6% of its 13F portfolio is allocated to the company. Other professional money managers with similar optimism encompass Allan Mecham and Ben Raybould’s Arlington Value Capital, Jim Simons’ Renaissance Technologies and Ken Fisher’s Fisher Asset Management.

Due to the fact that MSC Industrial Direct Co Inc (NYSE:MSM) has witnessed falling interest from hedge fund managers, it’s safe to say that there is a sect of hedgies who were dropping their entire stakes heading into Q4. Interestingly, Steve Cohen’s Point72 Asset Management said goodbye to the largest stake of all the hedgies monitored by Insider Monkey, valued at close to $7.9 million in stock, and George Hall’s Clinton Group was right behind this move, as the fund said goodbye to about $5.4 million worth of shares. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 5 funds heading into Q4.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as MSC Industrial Direct Co Inc (NYSE:MSM) but similarly valued. We will take a look at DCT Industrial Trust Inc. (NYSE:DCT), Compania Cervecerias Unidas S.A. (ADR) (NYSE:CCU), PTC Inc (NASDAQ:PTC), and Sally Beauty Holdings, Inc. (NYSE:SBH). This group of stocks’ market values are closest to MSM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCT | 9 | 113662 | -3 |

| CCU | 10 | 52657 | 0 |

| PTC | 30 | 987607 | -2 |

| SBH | 12 | 115791 | -5 |

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $317 million. That figure was $556 million in MSM’s case. PTC Inc (NASDAQ:PTC) is the most popular stock in this table. On the other hand DCT Industrial Trust Inc. (NYSE:DCT) is the least popular one with only 9 bullish hedge fund positions. MSC Industrial Direct Co Inc (NYSE:MSM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds really like. In this regard PTC might be a better candidate to consider a long position in.

Disclosure: None