Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 12.1% in 2019 (through May 30th). Conversely, hedge funds’ 20 preferred S&P 500 stocks generated a return of 18.7% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like MKS Instruments, Inc. (NASDAQ:MKSI).

MKS Instruments, Inc. (NASDAQ:MKSI) shareholders have witnessed a decrease in hedge fund interest recently. Our calculations also showed that MKSI isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are viewed as unimportant, old financial tools of yesteryear. While there are greater than 8000 funds in operation today, We hone in on the leaders of this club, approximately 750 funds. These investment experts have their hands on most of the smart money’s total asset base, and by monitoring their highest performing stock picks, Insider Monkey has come up with a few investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the latest hedge fund action encompassing MKS Instruments, Inc. (NASDAQ:MKSI).

How have hedgies been trading MKS Instruments, Inc. (NASDAQ:MKSI)?

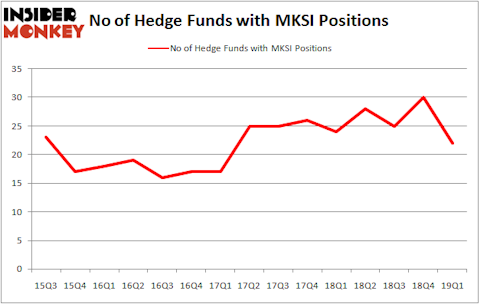

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MKSI over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of MKS Instruments, Inc. (NASDAQ:MKSI), with a stake worth $170.5 million reported as of the end of March. Trailing Renaissance Technologies was Royce & Associates, which amassed a stake valued at $120.2 million. AQR Capital Management, Fisher Asset Management, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that MKS Instruments, Inc. (NASDAQ:MKSI) has witnessed declining sentiment from the aggregate hedge fund industry, it’s safe to say that there was a specific group of money managers that decided to sell off their full holdings last quarter. Interestingly, John Overdeck and David Siegel’s Two Sigma Advisors sold off the largest position of all the hedgies tracked by Insider Monkey, valued at an estimated $4 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund dumped about $2.5 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 8 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to MKS Instruments, Inc. (NASDAQ:MKSI). We will take a look at Popular Inc (NASDAQ:BPOP), IDACORP Inc (NYSE:IDA), Seaboard Corporation (NYSE:SEB), and Grupo Aeroportuario del Pacifico, S.A.B. de C.V. (NYSE:PAC). This group of stocks’ market values are similar to MKSI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BPOP | 33 | 776860 | 1 |

| IDA | 18 | 243743 | -2 |

| SEB | 11 | 68653 | 1 |

| PAC | 7 | 85862 | 4 |

| Average | 17.25 | 293780 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $294 million. That figure was $560 million in MKSI’s case. Popular Inc (NASDAQ:BPOP) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Pacifico, S.A.B. de C.V. (NYSE:PAC) is the least popular one with only 7 bullish hedge fund positions. MKS Instruments, Inc. (NASDAQ:MKSI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MKSI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MKSI were disappointed as the stock returned -21.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.