The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 866 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31st holdings, data that is available nowhere else. Should you consider Hilton Worldwide Holdings Inc (NYSE:HLT) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

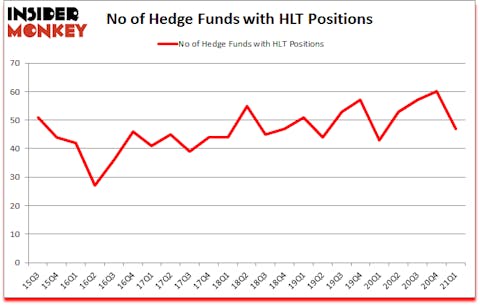

Hilton Worldwide Holdings Inc (NYSE:HLT) shareholders have witnessed a decrease in hedge fund interest of late. Hilton Worldwide Holdings Inc (NYSE:HLT) was in 47 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 60. There were 60 hedge funds in our database with HLT positions at the end of the fourth quarter. Our calculations also showed that HLT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most shareholders, hedge funds are viewed as slow, outdated financial tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts hone in on the leaders of this club, approximately 850 funds. These investment experts manage the majority of the hedge fund industry’s total capital, and by monitoring their matchless stock picks, Insider Monkey has come up with many investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to analyze the latest hedge fund action surrounding Hilton Worldwide Holdings Inc (NYSE:HLT).

Do Hedge Funds Think HLT Is A Good Stock To Buy Now?

At first quarter’s end, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HLT over the last 23 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Pershing Square, managed by Bill Ackman, holds the biggest position in Hilton Worldwide Holdings Inc (NYSE:HLT). Pershing Square has a $1.5573 billion position in the stock, comprising 14.9% of its 13F portfolio. Coming in second is Boykin Curry of Eagle Capital Management, with a $958.4 million position; 3% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism consist of Daniel Sundheim’s D1 Capital Partners, and Gabriel Plotkin’s Melvin Capital Management. In terms of the portfolio weights assigned to each position Pershing Square allocated the biggest weight to Hilton Worldwide Holdings Inc (NYSE:HLT), around 14.89% of its 13F portfolio. Pelham Capital is also relatively very bullish on the stock, designating 8.34 percent of its 13F equity portfolio to HLT.

Because Hilton Worldwide Holdings Inc (NYSE:HLT) has experienced a decline in interest from hedge fund managers, it’s easy to see that there were a few fund managers that elected to cut their positions entirely by the end of the first quarter. At the top of the heap, Andreas Halvorsen’s Viking Global dumped the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling about $525.1 million in stock. Eric W. Mandelblatt and Gaurav Kapadia’s fund, Soroban Capital Partners, also sold off its stock, about $114.6 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 13 funds by the end of the first quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Hilton Worldwide Holdings Inc (NYSE:HLT) but similarly valued. We will take a look at Corning Incorporated (NYSE:GLW), Zimmer Biomet Holdings Inc (NYSE:ZBH), Peloton Interactive, Inc. (NASDAQ:PTON), Marvell Technology, Inc. (NASDAQ:MRVL), Orange SA (NYSE:ORAN), The Hershey Company (NYSE:HSY), and Wayfair Inc (NYSE:W). This group of stocks’ market valuations resemble HLT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLW | 32 | 507110 | -7 |

| ZBH | 50 | 2151143 | -3 |

| PTON | 64 | 3963327 | 1 |

| MRVL | 33 | 683159 | -7 |

| ORAN | 2 | 10613 | -1 |

| HSY | 42 | 1267940 | 3 |

| W | 37 | 4012752 | -3 |

| Average | 37.1 | 1799435 | -2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.1 hedge funds with bullish positions and the average amount invested in these stocks was $1799 million. That figure was $5139 million in HLT’s case. Peloton Interactive, Inc. (NASDAQ:PTON) is the most popular stock in this table. On the other hand Orange SA (NYSE:ORAN) is the least popular one with only 2 bullish hedge fund positions. Hilton Worldwide Holdings Inc (NYSE:HLT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for HLT is 51.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and beat the market again by 6.1 percentage points. Unfortunately HLT wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on HLT were disappointed as the stock returned 2.3% since the end of March (through 6/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Hilton Worldwide Holdings Inc. (NYSE:HLT)

Follow Hilton Worldwide Holdings Inc. (NYSE:HLT)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Oil Stocks To Buy Now

- 10 Fastest Growing Franchises in the US

Disclosure: None. This article was originally published at Insider Monkey.