We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards CyrusOne Inc (NASDAQ:CONE).

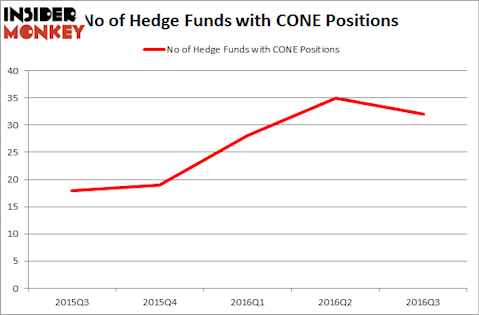

CyrusOne Inc (NASDAQ:CONE) was in 32 hedge funds’ portfolios at the end of the third quarter of 2016. CONE has seen a decrease in hedge fund sentiment in recent months. There were 35 hedge funds in our database with CONE holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Arista Networks Inc (NYSE:ANET), Dun & Bradstreet Corp (NYSE:DNB), and Healthcare Trust Of America Inc (NYSE:HTA) to gather more data points.

Follow Cyrusone Inc. (NASDAQ:CONE)

Follow Cyrusone Inc. (NASDAQ:CONE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alexander Raths/Shutterstock.com

What have hedge funds been doing with CyrusOne Inc (NASDAQ:CONE)?

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 9% from the previous quarter. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Marshall Wace LLP, managed by Paul Marshall and Ian Wace, holds the number one position in CyrusOne Inc (NASDAQ:CONE). Marshall Wace LLP has a $51.7 million position in the stock, and the second most bullish fund manager is Israel Englander of Millennium Management, with a $46.8 million position. Remaining professional money managers that are bullish contain Greg Poole’s Echo Street Capital Management, D. E. Shaw’s D E Shaw and Seymour Sy Kaufman and Michael Stark’s Crosslink Capital.