We at Insider Monkey have gone over 867 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Novo Nordisk A/S (NYSE:NVO) based on that data.

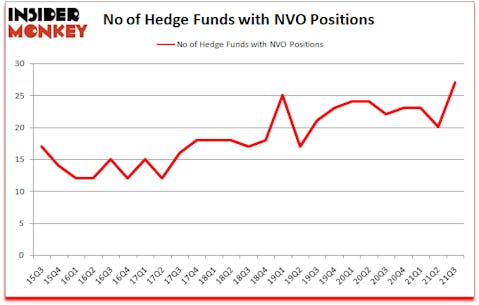

Novo Nordisk A/S (NYSE:NVO) investors should be aware of an increase in hedge fund sentiment recently. Novo Nordisk A/S (NYSE:NVO) was in 27 hedge funds’ portfolios at the end of September. The all time high for this statistic was previously 25. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 20 hedge funds in our database with NVO holdings at the end of June. Our calculations also showed that NVO isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to take a peek at the new hedge fund action encompassing Novo Nordisk A/S (NYSE:NVO).

Tom Gayner of Markel Gayner Asset Management

Do Hedge Funds Think NVO Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NVO over the last 25 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the number one position in Novo Nordisk A/S (NYSE:NVO). Renaissance Technologies has a $2.0777 billion position in the stock, comprising 2.7% of its 13F portfolio. Coming in second is Fisher Asset Management, managed by Ken Fisher, which holds a $1.553 billion position; 1% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism comprise Tom Gayner’s Markel Gayner Asset Management, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Renaissance Technologies allocated the biggest weight to Novo Nordisk A/S (NYSE:NVO), around 2.68% of its 13F portfolio. Markel Gayner Asset Management is also relatively very bullish on the stock, earmarking 1.3 percent of its 13F equity portfolio to NVO.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the largest position in Novo Nordisk A/S (NYSE:NVO). Arrowstreet Capital had $37.2 million invested in the company at the end of the quarter. Alec Litowitz and Ross Laser’s Magnetar Capital also initiated a $10.8 million position during the quarter. The following funds were also among the new NVO investors: Zach Schreiber’s Point State Capital, William Harnisch’s Peconic Partners LLC, and Richard SchimeláandáLawrence Sapanski’s Cinctive Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Novo Nordisk A/S (NYSE:NVO). We will take a look at Danaher Corporation (NYSE:DHR), Intel Corporation (NASDAQ:INTC), Abbott Laboratories (NYSE:ABT), PepsiCo, Inc. (NASDAQ:PEP), Accenture Plc (NYSE:ACN), Broadcom Inc (NASDAQ:AVGO), and Costco Wholesale Corporation (NASDAQ:COST). All of these stocks’ market caps are closest to NVO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHR | 74 | 6946837 | -4 |

| INTC | 66 | 6472854 | -12 |

| ABT | 63 | 3611527 | 2 |

| PEP | 61 | 4435441 | -5 |

| ACN | 56 | 4460650 | 4 |

| AVGO | 50 | 2706386 | 3 |

| COST | 55 | 4393346 | 1 |

| Average | 60.7 | 4718149 | -1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 60.7 hedge funds with bullish positions and the average amount invested in these stocks was $4718 million. That figure was $4053 million in NVO’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand Broadcom Inc (NASDAQ:AVGO) is the least popular one with only 50 bullish hedge fund positions. Compared to these stocks Novo Nordisk A/S (NYSE:NVO) is even less popular than AVGO. Our overall hedge fund sentiment score for NVO is 40. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds clearly dropped the ball on NVO as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and still beat the market by 5.1 percentage points. A small number of hedge funds were also right about betting on NVO as the stock returned 18.3% since Q3 (through December 9th) and outperformed the market by an even larger margin.

Follow Novo Nordisk A S (NYSE:NVO)

Follow Novo Nordisk A S (NYSE:NVO)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Richest People in Central and South America

- 15 Largest Vehicles In The World

- 20 Most Deadliest and Dangerous Snakes In the World

Disclosure: None. This article was originally published at Insider Monkey.