The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Tempur Sealy International Inc (NYSE:TPX).

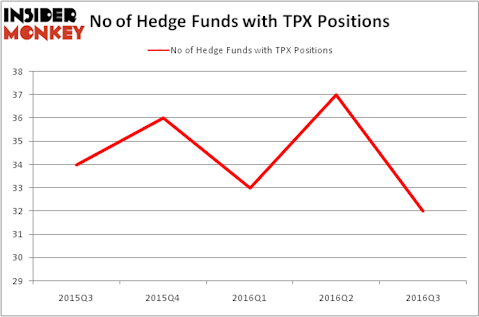

Tempur Sealy International Inc (NYSE:TPX) shareholders have witnessed a decrease in hedge fund sentiment of late, as 5 fewer hedge funds own the stock. At the end of this article we will also compare TPX to other stocks including World Fuel Services Corporation (NYSE:INT), Kirby Corporation (NYSE:KEX), and Seaboard Corporation (NYSEAMEX:SEB) to get a better sense of its popularity.

Follow Somnigroup International Inc. (NYSE:SGI)

Follow Somnigroup International Inc. (NYSE:SGI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: archidea / 123RF Stock Photo

With all of this in mind, let’s take a look at the key action regarding Tempur Sealy International Inc (NYSE:TPX).

How are hedge funds trading Tempur Sealy International Inc (NYSE:TPX)?

Heading into the fourth quarter of 2016, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a 14% drop from the previous quarter. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, H Partners Management, managed by Rehan Jaffer, holds the most valuable position in Tempur Sealy International Inc (NYSE:TPX). H Partners Management has a $397.2 million position in the stock, comprising 32.2% of its 13F portfolio. Coming in second is Chieftain Capital, led by John Shapiro, holding a $190.2 million position; 11% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism include Rob Citrone’s Discovery Capital Management, Philip Uhde’s Echinus Advisors, and Ryan Pedlow’s Two Creeks Capital Management.