Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

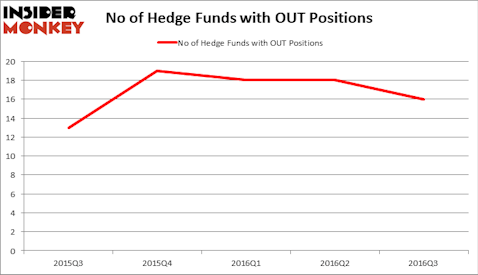

Outfront Media Inc (NYSE:OUT) was in 16 hedge funds’ portfolios at the end of September. OUT investors should be aware of a decrease in hedge fund interest in recent months. There were 18 hedge funds in our database with OUT holdings at the end of the previous quarter. At the end of this article we will also compare OUT to other stocks including Rayonier Inc. (NYSE:RYN), Monolithic Power Systems, Inc. (NASDAQ:MPWR), and World Fuel Services Corporation (NYSE:INT) to get a better sense of its popularity.

Follow Outfront Media Inc. (NYSE:OUT)

Follow Outfront Media Inc. (NYSE:OUT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Shutter_M/Shutterstock.com

How have hedgies been trading Outfront Media Inc (NYSE:OUT)?

Heading into the fourth quarter of 2016, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards OUT over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Route One Investment Company, led by William Duhamel, holds the most valuable position in Outfront Media Inc (NYSE:OUT). Route One Investment Company has a $109 million position in the stock, comprising 4.9% of its 13F portfolio. The second most bullish fund manager is York Capital Management, led by James Dinan, which holds a $52.1 million position; 1.7% of its 13F portfolio is allocated to the stock. Some other professional money managers that hold long positions encompass John Overdeck and David Siegel’s Two Sigma Advisors, Jim Simons’ Renaissance Technologies and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that cut their entire stakes in the stock during the third quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest investment of the “upper crust” of funds followed by Insider Monkey, valued at close to $4.6 million in stock, and Michael Platt and William Reeves’ BlueCrest Capital Mgmt. was right behind this move, as the fund dropped about $1.6 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Outfront Media Inc (NYSE:OUT) but similarly valued. These stocks are Rayonier Inc. (NYSE:RYN), Monolithic Power Systems, Inc. (NASDAQ:MPWR), World Fuel Services Corporation (NYSE:INT), and Deluxe Corporation (NYSE:DLX). All of these stocks’ market caps match OUT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RYN | 15 | 346535 | 5 |

| MPWR | 19 | 185808 | 1 |

| INT | 21 | 113629 | -3 |

| DLX | 17 | 87231 | -3 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $183 million. That figure was $230 million in OUT’s case. World Fuel Services Corporation (NYSE:INT) is the most popular stock in this table. On the other hand Rayonier Inc. (NYSE:RYN) is the least popular one with only 15 bullish hedge fund positions. Outfront Media Inc (NYSE:OUT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard INT might be a better candidate to consider taking a long position in.

Disclosure: None