In this article we will check out the progression of hedge fund sentiment towards KBR, Inc. (NYSE:KBR) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

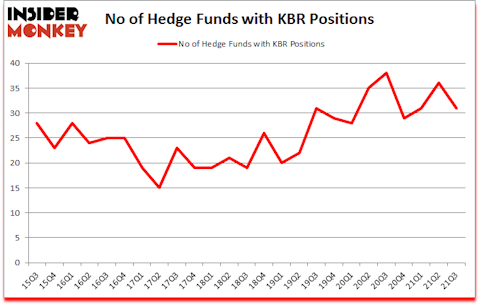

KBR, Inc. (NYSE:KBR) has experienced a decrease in hedge fund interest lately. KBR, Inc. (NYSE:KBR) was in 31 hedge funds’ portfolios at the end of September. The all time high for this statistic is 38. Our calculations also showed that KBR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to take a gander at the fresh hedge fund action encompassing KBR, Inc. (NYSE:KBR).

Do Hedge Funds Think KBR Is A Good Stock To Buy Now?

At the end of September, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards KBR over the last 25 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Pelham Capital, managed by Ross Turner, holds the most valuable position in KBR, Inc. (NYSE:KBR). Pelham Capital has a $169.7 million position in the stock, comprising 9.4% of its 13F portfolio. The second largest stake is held by Impactive Capital, managed by Lauren Taylor Wolfe, which holds a $155.6 million position; the fund has 12.2% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish contain Aaron Cowen’s Suvretta Capital Management, Matt Sirovich and Jeremy Mindich’s Scopia Capital and David S. Winter and David J. Millstone’s 40 North Management. In terms of the portfolio weights assigned to each position Impactive Capital allocated the biggest weight to KBR, Inc. (NYSE:KBR), around 12.21% of its 13F portfolio. Pelham Capital is also relatively very bullish on the stock, setting aside 9.41 percent of its 13F equity portfolio to KBR.

Since KBR, Inc. (NYSE:KBR) has experienced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there is a sect of hedge funds who were dropping their positions entirely by the end of the third quarter. Intriguingly, Claus Moller’s P2 Capital Partners dumped the largest investment of the 750 funds monitored by Insider Monkey, totaling an estimated $18.3 million in stock, and Renaissance Technologies was right behind this move, as the fund cut about $17.8 million worth. These transactions are interesting, as total hedge fund interest fell by 5 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to KBR, Inc. (NYSE:KBR). These stocks are Douglas Emmett, Inc. (NYSE:DEI), Cousins Properties Incorporated (NYSE:CUZ), Owl Rock Capital Corporation (NYSE:ORCC), Innovative Industrial Properties, Inc. (NYSE:IIPR), BlackBerry Limited (NYSE:BB), Eagle Materials, Inc. (NYSE:EXP), and Spirit Realty Capital Inc (NYSE:SRC). All of these stocks’ market caps resemble KBR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DEI | 13 | 291446 | -6 |

| CUZ | 14 | 170754 | -3 |

| ORCC | 14 | 180844 | -1 |

| IIPR | 12 | 265784 | -3 |

| BB | 20 | 569356 | 0 |

| EXP | 36 | 187715 | 0 |

| SRC | 23 | 384118 | 4 |

| Average | 18.9 | 292860 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.9 hedge funds with bullish positions and the average amount invested in these stocks was $293 million. That figure was $1056 million in KBR’s case. Eagle Materials, Inc. (NYSE:EXP) is the most popular stock in this table. On the other hand Innovative Industrial Properties, Inc. (NYSE:IIPR) is the least popular one with only 12 bullish hedge fund positions. KBR, Inc. (NYSE:KBR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for KBR is 64.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. Hedge funds were also right about betting on KBR as the stock returned 11.7% since the end of Q3 (through 11/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Kbr Inc. (NYSE:KBR)

Follow Kbr Inc. (NYSE:KBR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Most Valuable Companies In The World in February 2021

- 10 Best Small-Cap Biotech Stocks Under $10 in 2021

- 10 Best AI Stocks under $50

Disclosure: None. This article was originally published at Insider Monkey.