It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in ImmunoGen, Inc. (NASDAQ:IMGN).

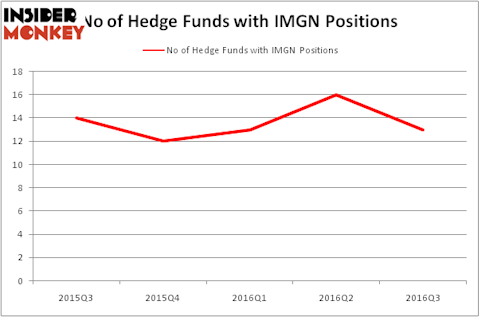

Is ImmunoGen, Inc. (NASDAQ:IMGN) a healthy stock for your portfolio? Hedge funds are actually getting less optimistic. The number of long hedge fund investments contracted by3 lately. IMGN was in 13 hedge funds’ portfolios at the end of September. There were 16 hedge funds in our database with IMGN positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as TerraVia Holdings, Inc. (NASDAQ:TVIA), Capital Southwest Corporation (NASDAQ:CSWC), and Fluidigm Corporation (NASDAQ:FLDM) to gather more data points.

Follow Immunogen Inc. (NASDAQ:IMGN)

Follow Immunogen Inc. (NASDAQ:IMGN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

science photo/Shutterstock.com

What does the smart money think about ImmunoGen, Inc. (NASDAQ:IMGN)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a fall of 19% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in IMGN heading into this year. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, OrbiMed Advisors, led by Samuel Isaly, holds the number one position in ImmunoGen, Inc. (NASDAQ:IMGN). OrbiMed Advisors has a $16.3 million position in the stock. Sitting at the No. 2 spot is Baker Bros. Advisors, led by Julian Baker and Felix Baker, holding a $8.1 million position. Remaining professional money managers with similar optimism comprise Jim Simons’ Renaissance Technologies, Israel Englander’s Millennium Management and Ken Fisher’s Fisher Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since ImmunoGen, Inc. (NASDAQ:IMGN) has faced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedgies that decided to sell off their entire stakes by the end of the third quarter. It’s worth mentioning that Oleg Nodelman’s EcoR1 Capital cashed in the largest stake of all the hedgies tracked by Insider Monkey, valued at about $0.9 million in call options, and Ori Hershkovitz’s Nexthera Capital was right behind this move, as the fund cut about $0.4 million worth of shares.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ImmunoGen, Inc. (NASDAQ:IMGN) but similarly valued. We will take a look at TerraVia Holdings, Inc. (NASDAQ:TVIA), Capital Southwest Corporation (NASDAQ:CSWC), Fluidigm Corporation (NASDAQ:FLDM), and CSS Industries, Inc. (NYSE:CSS). This group of stocks’ market values are closest to IMGN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TVIA | 3 | 7093 | -2 |

| CSWC | 9 | 41238 | 2 |

| FLDM | 8 | 60996 | -4 |

| CSS | 4 | 38011 | -1 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $38 million in IMGN’s case. Capital Southwest Corporation (NASDAQ:CSWC) is the most popular stock in this table. On the other hand TerraVia Holdings, Inc. (NASDAQ:TVIA) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks ImmunoGen, Inc. (NASDAQ:IMGN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None