Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Broadcom Inc (NASDAQ:AVGO) changed recently.

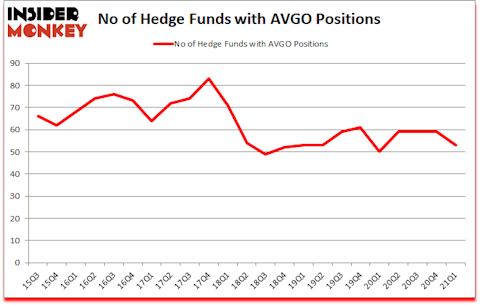

Broadcom Inc (NASDAQ:AVGO) was in 53 hedge funds’ portfolios at the end of March. The all time high for this statistic is 83. AVGO shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. There were 59 hedge funds in our database with AVGO holdings at the end of December. Our calculations also showed that AVGO isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

If you’d ask most investors, hedge funds are viewed as underperforming, old financial vehicles of yesteryear. While there are greater than 8000 funds trading today, Our experts choose to focus on the aristocrats of this group, approximately 850 funds. These money managers administer bulk of the smart money’s total capital, and by watching their first-class stock picks, Insider Monkey has uncovered various investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

William Von Mueffling of Cantillon Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, advertising technology one of the fastest growing industries right now, so we are checking out stock pitches like this under-the-radar adtech stock that can deliver 10x gains. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to view the latest hedge fund action regarding Broadcom Inc (NASDAQ:AVGO).

Do Hedge Funds Think AVGO Is A Good Stock To Buy Now?

At the end of March, a total of 53 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AVGO over the last 23 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Cantillon Capital Management, managed by William von Mueffling, holds the biggest position in Broadcom Inc (NASDAQ:AVGO). Cantillon Capital Management has a $516.1 million position in the stock, comprising 3.8% of its 13F portfolio. Sitting at the No. 2 spot is First Pacific Advisors LLC, led by Robert Rodriguez and Steven Romick, holding a $419.8 million position; 5.7% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions consist of Rajiv Jain’s GQG Partners, Andrew Wellington and Jeff Keswin’s Lyrical Asset Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position First Pacific Advisors LLC allocated the biggest weight to Broadcom Inc (NASDAQ:AVGO), around 5.7% of its 13F portfolio. 40 North Management is also relatively very bullish on the stock, dishing out 4.93 percent of its 13F equity portfolio to AVGO.

Because Broadcom Inc (NASDAQ:AVGO) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there exists a select few money managers who sold off their full holdings heading into Q2. It’s worth mentioning that Steve Cohen’s Point72 Asset Management cut the biggest stake of all the hedgies monitored by Insider Monkey, valued at an estimated $49.8 million in stock. Robert Boucai’s fund, Newbrook Capital Advisors, also dumped its stock, about $47.7 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 6 funds heading into Q2.

Let’s now take a look at hedge fund activity in other stocks similar to Broadcom Inc (NASDAQ:AVGO). These stocks are Accenture Plc (NYSE:ACN), Thermo Fisher Scientific Inc. (NYSE:TMO), Eli Lilly and Company (NYSE:LLY), Texas Instruments Incorporated (NASDAQ:TXN), BHP Group (NYSE:BHP), McDonald’s Corporation (NYSE:MCD), and Pinduoduo Inc. (NASDAQ:PDD). This group of stocks’ market caps are closest to AVGO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACN | 48 | 2350908 | -2 |

| TMO | 79 | 6254066 | -10 |

| LLY | 55 | 2522416 | 5 |

| TXN | 42 | 2532768 | -14 |

| BHP | 18 | 873686 | -2 |

| MCD | 67 | 3783829 | 5 |

| PDD | 56 | 6293871 | 2 |

| Average | 52.1 | 3515935 | -2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 52.1 hedge funds with bullish positions and the average amount invested in these stocks was $3516 million. That figure was $3313 million in AVGO’s case. Thermo Fisher Scientific Inc. (NYSE:TMO) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 18 bullish hedge fund positions. Broadcom Inc (NASDAQ:AVGO) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AVGO is 46.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and beat the market again by 3.3 percentage points. Unfortunately AVGO wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on AVGO were disappointed as the stock returned 1.5% since the end of March (through 6/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Broadcom Inc. (NASDAQ:AVGO)

Follow Broadcom Inc. (NASDAQ:AVGO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.