A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 30th, so let’s proceed with the discussion of the hedge fund sentiment on Zynga Inc (NASDAQ:ZNGA).

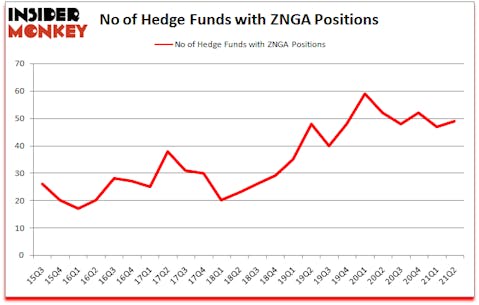

Is Zynga Inc (NASDAQ:ZNGA) a buy, sell, or hold? Investors who are in the know were taking a bullish view. The number of bullish hedge fund positions increased by 2 lately. Zynga Inc (NASDAQ:ZNGA) was in 49 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 59. Our calculations also showed that ZNGA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Today there are plenty of signals stock market investors can use to assess their holdings. Two of the most useful signals are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best money managers can trounce the broader indices by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

Keith Meister of Corvex Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a glance at the new hedge fund action regarding Zynga Inc (NASDAQ:ZNGA).

Do Hedge Funds Think ZNGA Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from one quarter earlier. By comparison, 52 hedge funds held shares or bullish call options in ZNGA a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, 0 held the most valuable stake in Zynga Inc (NASDAQ:ZNGA), which was worth $215.8 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $176.5 million worth of shares. Iridian Asset Management, Renaissance Technologies, and Junto Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Shelter Haven Capital Management allocated the biggest weight to Zynga Inc (NASDAQ:ZNGA), around 9.29% of its 13F portfolio. Dendur Capital is also relatively very bullish on the stock, designating 6.65 percent of its 13F equity portfolio to ZNGA.

Now, key money managers were breaking ground themselves. Junto Capital Management, managed by James Parsons, established the largest position in Zynga Inc (NASDAQ:ZNGA). Junto Capital Management had $75.4 million invested in the company at the end of the quarter. Joe Milano’s Greenhouse Funds also made a $19.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Robert Smith’s Vista Equity Partners, Keith Meister’s Corvex Capital, and Louis Bacon’s Moore Global Investments.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Zynga Inc (NASDAQ:ZNGA) but similarly valued. These stocks are A. O. Smith Corporation (NYSE:AOS), AMERCO (NASDAQ:UHAL), Cable One Inc (NYSE:CABO), Westlake Chemical Corporation (NYSE:WLK), Booz Allen Hamilton Holding Corporation (NYSE:BAH), Bruker Corporation (NASDAQ:BRKR), and RPM International Inc. (NYSE:RPM). This group of stocks’ market caps are closest to ZNGA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AOS | 26 | 584108 | 2 |

| UHAL | 21 | 817145 | -2 |

| CABO | 20 | 703195 | -3 |

| WLK | 35 | 269784 | 9 |

| BAH | 29 | 214976 | 0 |

| BRKR | 31 | 459507 | 9 |

| RPM | 22 | 91588 | 2 |

| Average | 26.3 | 448615 | 2.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.3 hedge funds with bullish positions and the average amount invested in these stocks was $449 million. That figure was $1270 million in ZNGA’s case. Westlake Chemical Corporation (NYSE:WLK) is the most popular stock in this table. On the other hand Cable One Inc (NYSE:CABO) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Zynga Inc (NASDAQ:ZNGA) is more popular among hedge funds. Our overall hedge fund sentiment score for ZNGA is 81.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.9% in 2021 through October 1st and still beat the market by 5.6 percentage points. Unfortunately ZNGA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ZNGA were disappointed as the stock returned -29.5% since the end of the second quarter (through 10/1) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Zynga Inc (NASDAQ:ZNGA)

Follow Zynga Inc (NASDAQ:ZNGA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 30 Most Expensive Cities in the US

- 10 Best Affordable Tech Stocks to Invest In Now

- Top 15 Serial Entrepreneurs In The World

Disclosure: None. This article was originally published at Insider Monkey.