It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like EQT Corporation (NYSE:EQT).

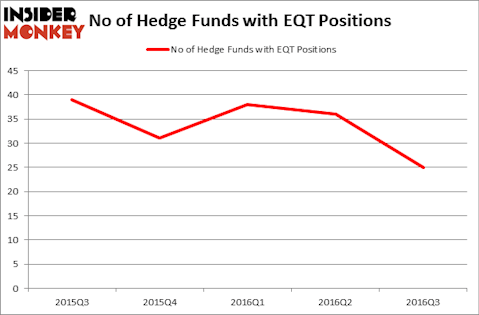

Is EQT Corporation (NYSE:EQT) the right pick for your portfolio? The best stock pickers are reducing their bets on the stock. The number of bullish hedge fund bets retreated by 11 lately. EQT was in 25 hedge funds’ portfolios at the end of the third quarter of 2016. There were 36 hedge funds in our database with EQT holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Laboratory Corp. of America Holdings (NYSE:LH), Markel Corporation (NYSE:MKL), and SK Telecom Co., Ltd. (ADR) (NYSE:SKM) to gather more data points.

Follow Eqt Corp (NYSE:EQT)

Follow Eqt Corp (NYSE:EQT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

huyangshu /shutterstock.com

What does the smart money think about EQT Corporation (NYSE:EQT)?

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a 31% fall from one quarter earlier, dragging hedge fund ownership down to a low point over the past five quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Anchor Bolt Capital, managed by Robert Polak, holds the number one position in EQT Corporation (NYSE:EQT). Anchor Bolt Capital has a $109.8 million position in the stock, comprising 3.4% of its 13F portfolio. The second most bullish fund manager is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding an $82.3 million position. Some other members of the smart money with similar optimism comprise Martin D. Sass’ MD Sass, Kamyar Khajavi’s MIK Capital, and David E. Shaw’s D E Shaw.