At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

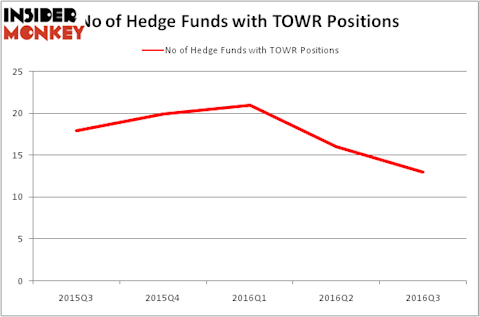

Is Tower International Inc (NYSE:TOWR) undervalued? Investors who are in the know are definitely getting less bullish. The number of bullish hedge fund bets that are revealed through the 13F filings went down by 3 recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as GenMark Diagnostics, Inc (NASDAQ:GNMK), Enanta Pharmaceuticals Inc (NASDAQ:ENTA), and Hostess Brands Inc (NASDAQ:GRSH) to gather more data points.

Follow Tower International Inc. (NYSE:TOWR)

Follow Tower International Inc. (NYSE:TOWR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Photology1971/Shutterstock.com

Hedge fund activity in Tower International Inc (NYSE:TOWR)

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 19% drop from the second quarter of 2016 and the second straight quarter with a notable drop in bullish hedge fund positions. There were a total of 20 hedge funds with a bullish position in TOWR at the beginning of this year. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital has the biggest position in Tower International Inc (NYSE:TOWR), worth close to $31.3 million. The second most bullish fund manager is Royce & Associates, led by Chuck Royce, holding an $18.5 million position. Some other hedge funds and institutional investors with similar optimism comprise Cliff Asness’ AQR Capital Management, David E. Shaw’s D E Shaw, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.