It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 30 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 15.1% over the last 12 months (vs. 5.6% gain for SPY), with 53% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Principal Financial Group Inc (NYSE:PFG).

Principal Financial Group Inc (NYSE:PFG) has experienced a decrease in hedge fund interest recently. Our calculations also showed that pfg isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the new hedge fund action regarding Principal Financial Group Inc (NYSE:PFG).

How are hedge funds trading Principal Financial Group Inc (NYSE:PFG)?

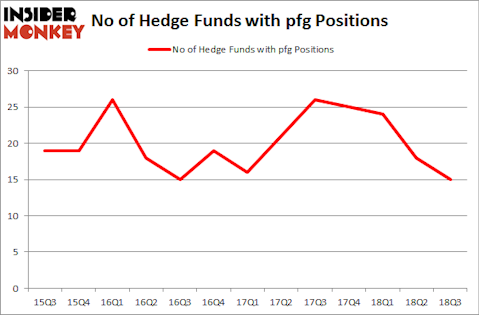

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PFG over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Two Sigma Advisors held the most valuable stake in Principal Financial Group Inc (NYSE:PFG), which was worth $79.1 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $35 million worth of shares. Moreover, GLG Partners, Adage Capital Management, and Impax Asset Management were also bullish on Principal Financial Group Inc (NYSE:PFG), allocating a large percentage of their portfolios to this stock.

Since Principal Financial Group Inc (NYSE:PFG) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there was a specific group of fund managers that slashed their full holdings in the third quarter. Intriguingly, Israel Englander’s Millennium Management cut the largest stake of all the hedgies watched by Insider Monkey, comprising about $22 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dropped its stock, about $20.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Principal Financial Group Inc (NASDAQ:PFG) but similarly valued. These stocks are Fastenal Company (NASDAQ:FAST), L-3 Technologies, Inc. (NYSE:LLL), SVB Financial Group (NASDAQ:SIVB), and STMicroelectronics N.V. (NYSE:STM). This group of stocks’ market caps match PFG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FAST | 23 | 1429182 | -1 |

| LLL | 26 | 867450 | 6 |

| SIVB | 37 | 1451045 | 0 |

| STM | 11 | 118040 | -7 |

| Average | 24.25 | 966429 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $966 million. That figure was $153 million in PFG’s case. SVB Financial Group (NASDAQ:SIVB) is the most popular stock in this table. On the other hand STMicroelectronics N.V. (NYSE:STM) is the least popular one with only 11 bullish hedge fund positions. Principal Financial Group Inc (NASDAQ:PFG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SIVB might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.