It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Morphic Holding, Inc. (NASDAQ:MORF).

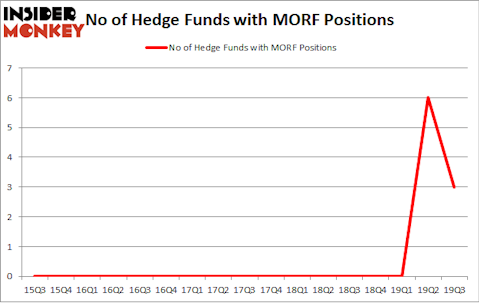

Morphic Holding, Inc. (NASDAQ:MORF) shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that MORF isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Oleg Nodelman of EcoR1 Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the recent hedge fund action regarding Morphic Holding, Inc. (NASDAQ:MORF).

What have hedge funds been doing with Morphic Holding, Inc. (NASDAQ:MORF)?

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -50% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MORF over the last 17 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Morphic Holding, Inc. (NASDAQ:MORF) was held by EcoR1 Capital, which reported holding $39.1 million worth of stock at the end of September. It was followed by Perceptive Advisors with a $11.8 million position. The only other hedge fund that is bullish on the company was Millennium Management.

Since Morphic Holding, Inc. (NASDAQ:MORF) has faced bearish sentiment from hedge fund managers, it’s easy to see that there were a few fund managers who were dropping their entire stakes heading into Q4. Intriguingly, Ken Griffin’s Citadel Investment Group said goodbye to the largest stake of all the hedgies watched by Insider Monkey, valued at about $1.6 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund sold off about $1.2 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 3 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to Morphic Holding, Inc. (NASDAQ:MORF). These stocks are AudioCodes Ltd. (NASDAQ:AUDC), EverQuote, Inc. (NASDAQ:EVER), i3 Verticals, Inc. (NASDAQ:IIIV), and Endurance International Group Holdings Inc (NASDAQ:EIGI). This group of stocks’ market valuations match MORF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AUDC | 13 | 22667 | 2 |

| EVER | 13 | 62810 | 2 |

| IIIV | 10 | 48762 | -3 |

| EIGI | 13 | 80023 | 2 |

| Average | 12.25 | 53566 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $52 million in MORF’s case. AudioCodes Ltd. (NASDAQ:AUDC) is the most popular stock in this table. On the other hand i3 Verticals, Inc. (NASDAQ:IIIV) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Morphic Holding, Inc. (NASDAQ:MORF) is even less popular than IIIV. Hedge funds dodged a bullet by taking a bearish stance towards MORF. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately MORF wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MORF investors were disappointed as the stock returned -7.3% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.