In this article we will check out the progression of hedge fund sentiment towards Kimball Electronics Inc (NASDAQ:KE) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

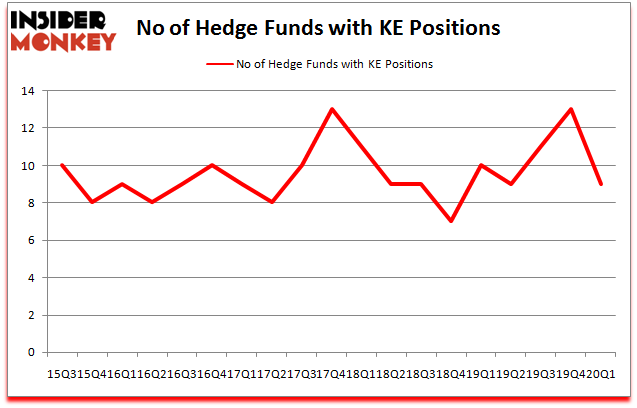

Kimball Electronics Inc (NASDAQ:KE) was in 9 hedge funds’ portfolios at the end of March. KE has experienced a decrease in support from the world’s most elite money managers in recent months. There were 13 hedge funds in our database with KE positions at the end of the previous quarter. Our calculations also showed that KE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most traders, hedge funds are assumed to be slow, old financial vehicles of the past. While there are greater than 8000 funds with their doors open at present, We look at the aristocrats of this club, about 850 funds. Most estimates calculate that this group of people have their hands on most of the hedge fund industry’s total capital, and by following their unrivaled picks, Insider Monkey has determined many investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a peek at the key hedge fund action regarding Kimball Electronics Inc (NASDAQ:KE).

How are hedge funds trading Kimball Electronics Inc (NASDAQ:KE)?

At Q1’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -31% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards KE over the last 18 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Royce & Associates was the largest shareholder of Kimball Electronics Inc (NASDAQ:KE), with a stake worth $5.3 million reported as of the end of September. Trailing Royce & Associates was Renaissance Technologies, which amassed a stake valued at $4.7 million. Ancora Advisors, Citadel Investment Group, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Zebra Capital Management allocated the biggest weight to Kimball Electronics Inc (NASDAQ:KE), around 0.26% of its 13F portfolio. Royce & Associates is also relatively very bullish on the stock, setting aside 0.07 percent of its 13F equity portfolio to KE.

Judging by the fact that Kimball Electronics Inc (NASDAQ:KE) has experienced falling interest from hedge fund managers, logic holds that there exists a select few money managers that decided to sell off their full holdings heading into Q4. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the biggest stake of the “upper crust” of funds monitored by Insider Monkey, totaling close to $0.6 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dropped about $0.3 million worth. These transactions are important to note, as total hedge fund interest fell by 4 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks similar to Kimball Electronics Inc (NASDAQ:KE). These stocks are Digi International Inc. (NASDAQ:DGII), ProQR Therapeutics NV (NASDAQ:PRQR), RBB Bancorp (NASDAQ:RBB), and Diebold Nixdorf Incorporated (NYSE:DBD). This group of stocks’ market caps are similar to KE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DGII | 11 | 29958 | -4 |

| PRQR | 8 | 49997 | -3 |

| RBB | 10 | 6686 | -1 |

| DBD | 17 | 59383 | -4 |

| Average | 11.5 | 36506 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $14 million in KE’s case. Diebold Nixdorf Incorporated (NYSE:DBD) is the most popular stock in this table. On the other hand ProQR Therapeutics NV (NASDAQ:PRQR) is the least popular one with only 8 bullish hedge fund positions. Kimball Electronics Inc (NASDAQ:KE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd and surpassed the market by 15.9 percentage points. Unfortunately KE wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); KE investors were disappointed as the stock returned 18.6% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Kimball Electronics Inc. (NASDAQ:KE)

Follow Kimball Electronics Inc. (NASDAQ:KE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.