You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

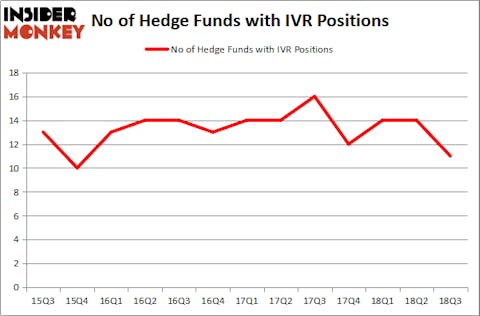

Invesco Mortgage Capital Inc (NYSE:IVR) investors should pay attention to a decrease in hedge fund sentiment of late. IVR was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with IVR holdings at the end of the previous quarter. Our calculations also showed that IVR isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the fresh hedge fund action regarding Invesco Mortgage Capital Inc (NYSE:IVR).

What does the smart money think about Invesco Mortgage Capital Inc (NYSE:IVR)?

Heading into the fourth quarter of 2018, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the second quarter of 2018. By comparison, 12 hedge funds held shares or bullish call options in IVR heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Ellington held the most valuable stake in Invesco Mortgage Capital Inc (NYSE:IVR), which was worth $3.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $3.4 million worth of shares. Moreover, AQR Capital Management, Holocene Advisors, and McKinley Capital Management were also bullish on Invesco Mortgage Capital Inc (NYSE:IVR), allocating a large percentage of their portfolios to this stock.

Because Invesco Mortgage Capital Inc (NYSE:IVR) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of funds who sold off their full holdings by the end of the third quarter. Interestingly, Matthew Tewksbury’s Stevens Capital Management cut the biggest stake of the 700 funds followed by Insider Monkey, valued at an estimated $0.6 million in stock. D. E. Shaw’s fund, D E Shaw, also cut its stock, about $0.5 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Invesco Mortgage Capital Inc (NYSE:IVR) but similarly valued. These stocks are Magellan Health Inc (NASDAQ:MGLN), Masonite International Corp (NYSE:DOOR), Advanced Drainage Systems, Inc. (NYSE:WMS), and American Assets Trust, Inc (NYSE:AAT). All of these stocks’ market caps are similar to IVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGLN | 20 | 248083 | -1 |

| DOOR | 21 | 338851 | 5 |

| WMS | 17 | 374714 | 1 |

| AAT | 11 | 130155 | -5 |

| Average | 17.25 | 272951 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $14 million in IVR’s case. Masonite International Corp (NYSE:DOOR) is the most popular stock in this table. On the other hand American Assets Trust, Inc (NYSE:AAT) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Invesco Mortgage Capital Inc (NYSE:IVR) is even less popular than AAT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.